In today’s fast-paced financial markets, the demand for efficiency and precision in trading operations has never been greater. Traders and investment firms are continually seeking innovative solutions to enhance their performance and streamline their workflows. One such solution is OMS (Order Management System) trading software, a crucial tool designed to optimize the trading process from order inception to execution and settlement. By integrating advanced technology, OMS trading software not only automates routine tasks but also provides traders with real-time data insights, risk management capabilities, and improved compliance features. This article explores how OMS trading software can revolutionize trading operations, reducing manual errors, increasing operational speed, and enabling traders to make informed decisions swiftly. With the ability to handle multiple asset classes and adapt to various trading strategies, an effective OMS empowers firms to respond to market changes proactively. As we delve into the key features and benefits of OMS trading software, we will highlight its role in fostering a more agile trading environment, ultimately paving the way for enhanced profitability and competitiveness in a rapidly evolving landscape.

Overview of OMS Trading Software Benefits

The implementation of OMS trading software provides significant advantages for firms navigating the complexities of financial markets. By automating the trade execution process, organizations can reduce operational risks and minimize errors associated with manual trading. This efficiency not only accelerates transaction speeds but also enhances overall decision-making capabilities through real-time data analytics and reporting. As a result, traders can swiftly respond to market changes, optimize their strategies, and ultimately improve their profitability.

Additionally, OMS trading software offers robust compliance features that help firms adhere to regulatory requirements, safeguarding against potential penalties and reputational damage. The software facilitates smooth communication between various stakeholders, including traders, compliance officers, and back-office teams, fostering collaboration and transparency throughout the trading process. With customizable interfaces and integration capabilities with other financial systems, businesses can tailor their OMS to meet specific operational needs, further enhancing their competitive edge in a fast-paced trading environment.

Discover how OMS software enhances trading efficacy and decision-making processes in diverse markets.

The versatility of OMS software is particularly beneficial across diverse market environments, allowing firms to tailor their trading strategies to specific asset classes and local regulations. This adaptability enables organizations to access multiple markets seamlessly, whether they are engaging in equities, fixed income, or derivatives trading. By consolidating various functions—such as order entry, execution, and post-trade analysis—OMS platforms provide a comprehensive view of trading activities, facilitating informed decision-making and strategic planning.

Moreover, the integration of advanced analytics and machine learning algorithms within OMS technologies empowers traders to uncover actionable insights from vast datasets. This capability not only enhances the precision of trading strategies but also enables predictive modeling, allowing firms to anticipate market movements and adjust their tactics accordingly. The combination of efficiency, adaptability, and analytical prowess positions OMS software as an essential tool for firms aiming to thrive in the competitive landscape of global trading.

Key Features of OMS Solutions

A robust OMS solution is characterized by its ability to facilitate real-time data processing and order management, ensuring that traders can execute transactions swiftly and accurately. Features such as automated order routing and smart order execution minimize latency, reducing the likelihood of missed opportunities in fast-paced markets. Additionally, risk management tools are integrated within these systems, allowing for comprehensive monitoring and mitigation of potential exposures throughout the trading lifecycle. This holistic approach ensures that organizations maintain compliance with regulatory standards while optimizing their trading performance.

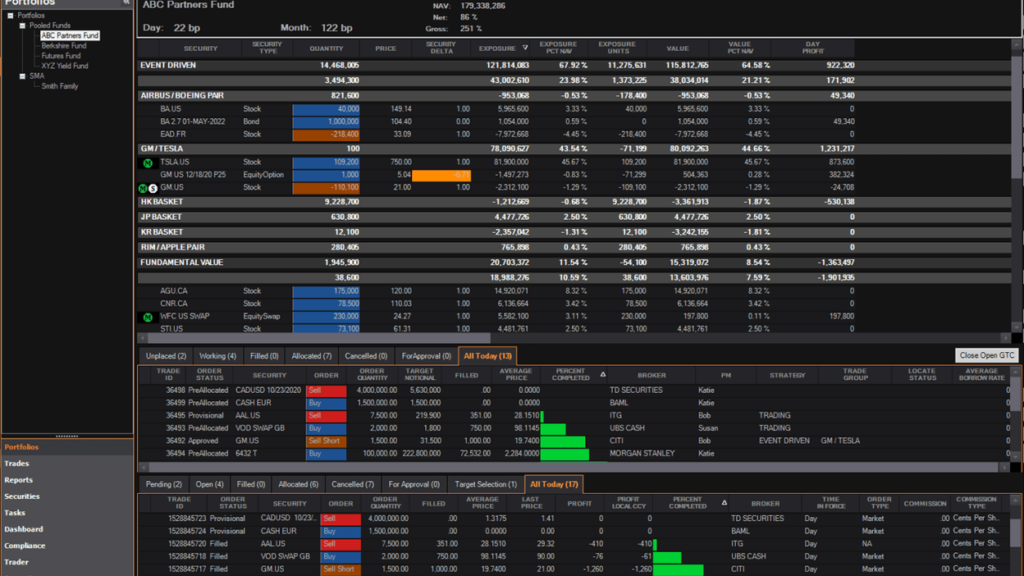

The user interface of an effective OMS is designed to enhance usability, providing traders with customizable dashboards that display pertinent metrics and analytics at a glance. This level of personalization allows users to focus on key performance indicators and market trends relevant to their specific strategies. Furthermore, seamless integration with other financial systems, such as risk management and compliance platforms, enriches the overall functionality of the OMS, creating a cohesive ecosystem that supports informed decision-making and operational efficiency. Overall, these features collectively contribute to a streamlined trading process, empowering firms to maintain a competitive edge in the ever-evolving financial landscape.

Explore essential features that optimize trading operations and improve overall performance in real-time.

Advanced analytics capabilities within an OMS are crucial for optimizing trading operations, as they provide insights into market dynamics and trading patterns in real time. By leveraging data visualization tools and algorithmic analysis, traders can identify trends, assess performance, and make informed decisions quickly. Features such as predictive analytics enable users to anticipate market movements and adjust their strategies proactively, which is vital in a landscape where split-second decisions can significantly affect outcomes.

Integration with various market data feeds and execution venues enhances the OMS’s effectiveness, ensuring that traders have access to the most current information. This connectivity facilitates seamless trade execution across multiple asset classes and geographies, allowing firms to capitalize on diverse opportunities. Furthermore, the incorporation of machine learning algorithms aids in refining trading strategies, as the system learns from past performance and user behavior, ultimately leading to improved accuracy and efficiency in operations.

Integration with Existing Trading Systems

The ability to seamlessly integrate with existing trading systems is essential for maximizing operational efficiency and maintaining a competitive edge. By ensuring compatibility with legacy systems and third-party applications, organizations can leverage their current technology investments while enhancing functionality. This interoperability not only reduces the need for extensive training on new platforms, but also minimizes disruption during the transition, allowing traders to continue their operations with minimal downtime.

Moreover, a well-integrated OMS can facilitate data sharing across various departments and functions, resulting in improved collaboration and decision-making. The consolidation of systems enables a holistic view of trading activities, facilitating better risk management and compliance monitoring. Ultimately, this integration empowers firms to respond swiftly to market changes and align their trading strategies more closely with their organizational objectives, driving both performance and profitability.

Learn how OMS seamlessly connects with your current infrastructure for enhanced functionality and efficiency.

The seamless connectivity of an Order Management System (OMS) with your existing infrastructure plays a pivotal role in enhancing overall operational efficiency. By integrating with current platforms, an OMS allows organizations to harness valuable data and insights that may have previously been siloed across different systems. This streamlined connectivity ensures that all trading activities are synchronized, enabling real-time access to critical information that supports informed decision-making. As a result, trading teams can operate more fluidly, adapting to market dynamics with greater agility.

Furthermore, the enhanced functionality derived from this integration fosters a more robust trading environment. The ability to automate processes and facilitate communication between various departments strengthens collaboration, leading to more coherent strategies and optimized workflows. With a comprehensive view of market trends and internal performance, firms can not only enhance their trading capabilities but also improve their compliance and risk management practices. This holistic approach ultimately positions organizations for sustained growth and success in an increasingly complex trading landscape.

User-Friendly Interface and Functionality

A well-designed interface is crucial for maximizing user engagement and operational efficiency within an order management system. By prioritizing user experience, traders and analysts can quickly navigate through complex data sets and execute trades with minimal friction. Intuitive layouts, clear visual indicators, and customizable dashboards not only reduce the learning curve for new users but also enhance productivity for seasoned professionals. When information is presented in a straightforward manner, users can focus on analysis and strategy rather than getting bogged down by cumbersome navigation.

In addition to a user-friendly interface, the functionality embedded in the system significantly influences its effectiveness. Features such as real-time analytics, automated alerts, and streamlined order processing empower users to make swift, informed decisions in constantly changing market conditions. Enhanced functionality—including the ability to personalize settings and create tailored reports—enables trading teams to work more efficiently and respond proactively to emerging opportunities. By fostering an environment where ease of use and powerful features coexist, organizations can ensure that their trading operations are both effective and adaptable.

Understand the importance of intuitive design in improving user experience and reducing training time.

Intuitive design plays a pivotal role in enhancing user experience, particularly in complex order management systems. When interfaces are thoughtfully constructed to align with users’ mental models, they significantly reduce the time and effort needed for training. This allows new users to acclimate more quickly, enabling them to engage with the software confidently without extensive onboarding sessions. By minimizing cognitive overload, intuitive design fosters a smoother transition into the system, ensuring that users can concentrate on their core responsibilities rather than navigating convoluted menus or deciphering unclear commands.

Moreover, an intuitive design contributes to sustained productivity by allowing users to leverage the software’s full potential without frequent reference materials or support interventions. As users become more adept at utilizing the system, they can deploy advanced features and functionalities effectively, resulting in improved operational efficiency. This seamless integration of user experience and functionality ultimately cultivates a more agile trading environment, where users can respond to market fluctuations with speed and precision. By investing in intuitive design, organizations not only enhance user satisfaction but also foster an ecosystem that champions efficiency and adaptability in trading operations.

Cost-Effectiveness of OMS Implementation

Investing in an order management system can yield substantial cost savings in both the short and long term. By automating various trading processes, firms can significantly reduce manual errors and operational inefficiencies that often lead to financial losses. The elimination of redundant tasks not only streamlines workflows but also allows staff to focus on higher-value activities, thereby maximizing resource allocation. Additionally, the enhanced data analytics capabilities of modern OMS solutions provide firms with critical insights that can inform strategic decision-making, leading to optimized trading strategies and better market positioning.

Furthermore, the scalability of contemporary order management systems enables institutions to adapt to changing market conditions without incurring excessive costs. As businesses grow, their operational demands evolve; a cost-effective OMS can adjust accordingly, supporting increased transaction volumes and incorporating new functionalities as needed. This flexibility minimizes the financial burden associated with outdated systems and ensures that firms remain competitive in a rapidly changing environment. Ultimately, the implementation of a robust OMS is not merely an expense but a strategic investment that can drive profitability and foster long-term growth.

Evaluate the financial benefits of adopting OMS software to maximize returns on investment in trading.

the latest regulatory requirements without necessitating a complete overhaul of existing systems. This adaptability not only preserves the initial investment but also enhances the potential for future growth. By integrating advanced analytical tools, firms can also leverage real-time data to make timely trading decisions, minimizing risks and capturing lucrative opportunities.

Moreover, the improved accuracy in trade execution and reporting provided by OMS software can directly translate into increased profitability. Reduced slippage, timely settlement processes, and better compliance management lead to enhanced reputational standing in the market, which can attract more clients and trading opportunities. Ultimately, the financial benefits of adopting such technology include not only immediate cost reductions but also long-term value creation through sustained competitive advantage and improved return on investment.

In conclusion, OMS trading software represents a significant advancement in the way trading operations are conducted, providing vital tools and features that enhance efficiency and decision-making. By integrating real-time data analysis, automated workflows, and comprehensive reporting capabilities, these systems empower traders to optimize their strategies while minimizing operational risks. As the financial landscape continues to evolve, adopting OMS software is not just a matter of staying competitive; it is essential for firms aiming to achieve maximum efficiency and profitability. As such, investing in the right OMS solution will ultimately pave the way for improved performance and a more streamlined trading experience in today’s fast-paced market environment.