Alright, California business owners, let’s talk about something we all love to… well, not love: paying taxes and fees. But hey, it’s a necessary evil, right? You’ve got your Limited Liability Company (LLC) all set up, ready to rock. That’s awesome! But here’s the deal: to keep that LLC in tip-top shape and legit with the state, you gotta pony up an annual fee. And yeah, it’s that infamous $800 fee. Don’t sweat it, though. This guide will walk you through how to manage your California LLC finances like a pro. We’ll break it down, so you can get it done and get back to doing what you do best: running your empire!

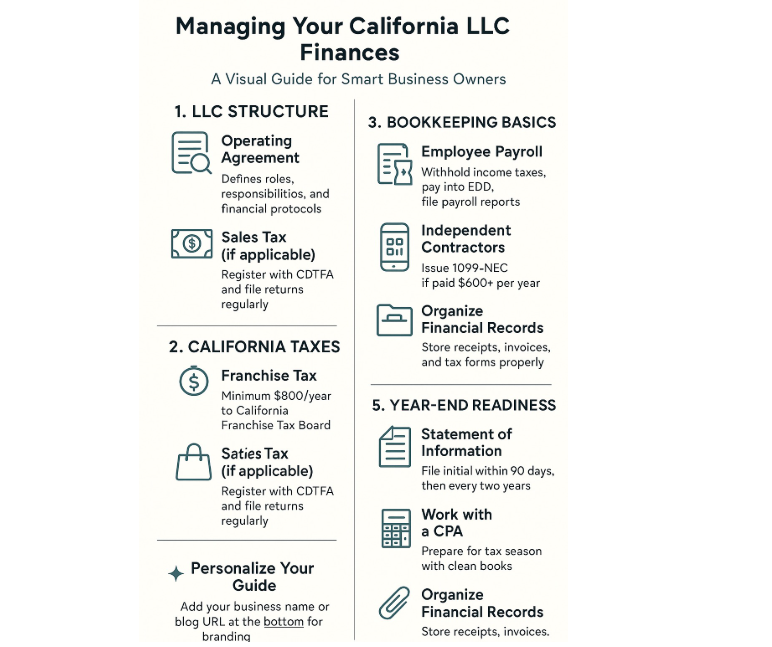

Setting Up Your Financial Infrastructure for Your California LLC

Before you start raking in the dough (or even before you spend your first dime), you gotta lay a solid foundation. That means setting up the right financial infrastructure for your California LLC. Think of it as building a strong house; you need a solid base before you add the fancy stuff.

Choosing the Right Business Bank Account

First and foremost, and I cannot emphasize this enough, get a separate bank account for your business. I’m serious. Mixing your personal and business money is a recipe for disaster. It turns accounting into a nightmare, blurs the lines of liability (which defeats a key purpose of the LLC!), and just looks unprofessional to any potential partners or lenders.

Here’s what to look for in a business bank account:

- Low fees: You’re a small business, not a bank’s ATM. Avoid accounts with high monthly fees, transaction charges, or sneaky hidden costs. Shop around!

- Online banking: In this day and age, easy access to your account 24/7 is absolutely essential. You need to be able to check your balance, transfer funds, and pay bills from anywhere.

- Integration with accounting software: This is a huge time-saver and will streamline your bookkeeping. Look for accounts that can connect directly with programs like QuickBooks or Xero.

- Business credit card options: Building business credit is crucial for future growth. See if the bank offers cards with rewards or good interest rates.

Selecting Accounting Software for Your LLC

Ditch the spreadsheets… well, at least mostly ditch them. While spreadsheets can be useful for some things, accounting software will quickly become your best friend. It’ll help you track income, expenses, invoices, and everything in between with a level of accuracy and efficiency that spreadsheets can’t match.

Popular accounting software options include:

- QuickBooks Online: A classic, widely used, and generally reliable.

- Xero: A strong contender, known for its user-friendly interface.

- FreshBooks: Excellent for service-based businesses that heavily rely on invoicing.

Choose one that fits your budget, your technical skills, and the specific needs of your business. Even a basic plan is way better than trying to cobble everything together in Excel.

Setting Up Payment Processing Systems

If your California LLC is selling anything (products or services), you’ll need a way to accept payments from customers. Cash is king, sure, but you can’t rely on it alone. Payment processing systems make it easy to accept various forms of payment.

Popular payment processing options include:

- Stripe: A powerful and versatile option, good for online and in-person sales.

- PayPal: A widely recognized and trusted platform.

- Square: Excellent for mobile and point-of-sale transactions.

Consider factors like transaction fees, processing speed, and ease of integration with your website or point-of-sale system.

Bookkeeping and Record-Keeping

Okay, now let’s talk about the real fun (said no one ever): bookkeeping and record-keeping. I know, I know, it sounds about as exciting as watching paint dry. But trust me on this one: it’s the absolute backbone of your LLC’s financial health. You can’t run a successful business if you don’t know where your money is coming from and where it’s going.

Creating a Chart of Accounts

A chart of accounts is basically a master list of all the categories you use to track your money. Think of it as an organizational system for your finances. It’s a list of all your:

- Income categories (like sales revenue, service fees, etc.)

- Expense categories (like rent, utilities, supplies, etc.)

- Asset categories (like cash, equipment, etc.)

- Liability categories (like loans payable, accounts payable, etc.)

- Equity categories (like owner’s contributions)

Setting up a well-structured chart of accounts will make it much easier to categorize your transactions and generate accurate financial reports.

Tracking Income and Expenses Accurately

This is where the rubber meets the road. You gotta track every single dollar coming in and every single dollar going out. No exceptions! This means:

- Recording all sales and revenue: Every sale, every service fee, every bit of money your LLC earns needs to be documented.

- Documenting all expenses with receipts and invoices: Hold onto those receipts! They’re your proof of purchase. And make sure you get invoices from your vendors.

- Categorizing everything correctly in your accounting software: This is where that chart of accounts comes in handy. Assign each transaction to the right category.

Managing Invoices and Payments

If your California LLC bills clients for services or products, you need to manage your invoices and payments effectively. This includes:

- Creating and sending professional-looking invoices.

- Tracking when payments are due.

- Following up on late payments (politely, but firmly).

- Keeping detailed records of all invoices and payments.

Reconciling Bank Statements

Regularly reconciling bank statements is like double-checking your work. It involves comparing your accounting records with your actual bank statements to ensure that everything matches up. This helps you:

- Catch errors in your accounting.

- Identify any unauthorized transactions.

- Ensure the accuracy of your financial reports.

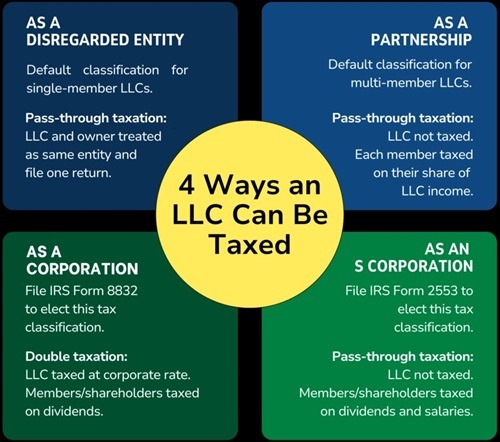

Navigating California LLC Tax Obligations

Alright, let’s wade into the often-murky waters of tax. California LLCs, like all businesses, have tax obligations, both at the federal and state levels. It’s important to understand these to stay compliant and avoid penalties.

Understanding the California Franchise Tax

Every LLC operating in California, even if it doesn’t make a dime, has to pay an annual franchise tax. It’s basically a fee for the privilege of doing business in California as an LLC. The minimum amount is currently $800, and you pay it to the California Franchise Tax Board (FTB).

Sales and Use Tax Responsibilities

If your California LLC sells tangible personal property (like physical goods), you’re probably gonna have to deal with sales and use tax. This is a tax that you collect from your customers and then remit to the California Department of Tax and Fee Administration (CDTFA).

Payroll Tax Requirements (If Your LLC Has Employees)

If you’re hiring employees, you’re entering a whole new world of tax fun (again, sarcasm). You’ll be responsible for withholding and paying payroll taxes, including:

- Federal income tax

- State income tax

- Social Security and Medicare taxes

- Unemployment insurance

- State disability insurance

Budgeting and Forecasting

You can’t just fly by the seat of your pants when it comes to finances. Budgeting and forecasting are essential for planning your LLC’s future and making smart decisions.

Creating a Budget for Your LLC

A budget is a detailed plan for how your LLC will earn and spend money over a specific period (like a month, quarter, or year). It’s like a roadmap for your money.

A good budget helps you:

- Control your spending: By knowing where your money is supposed to go, you’re less likely to overspend.

- Allocate resources effectively: You can decide how much money to invest in different areas of your business.

- Achieve your financial goals: Whether it’s increasing profitability, paying off debt, or expanding your operations, a budget helps you get there.

Forecasting Revenue and Expenses

Forecasting is about predicting your future revenue and expenses. It’s like trying to see into a crystal ball, but with numbers instead of magic.

Accurate forecasting helps you:

- Anticipate cash flow problems: You can see if you’re likely to run out of money in the future.

- Make informed decisions about investments: You can decide if you can afford to hire new employees or buy new equipment.

- Set realistic goals: You can set achievable targets for sales and profitability.

Using Financial Ratios for Analysis

Financial ratios are tools that help you analyze your LLC’s financial performance. They give you insights into things like:

- Profitability: How much profit you’re making compared to your revenue.

- Liquidity: Your ability to meet your short-term obligations.

- Solvency: Your ability to meet your long-term obligations.

Understanding financial ratios can help you identify areas where your LLC is doing well and areas where you need to improve.

Managing Cash Flow and Expenses for Your LLC

Cash flow is the movement of money into and out of your business. It’s the lifeblood of your LLC. And expenses Well, they’re the things that suck that lifeblood out. Managing cash flow and expenses effectively is absolutely crucial for your LLC’s survival and growth.

Strategies for Improving Cash Flow

Here are some strategies to boost your cash flow:

- Invoice promptly and follow up on late payments: Don’t let clients drag their feet on paying you.

- Offer discounts for early payments: A little incentive can go a long way.

- Negotiate better payment terms with suppliers: Try to get longer to pay your bills.

- Manage your inventory efficiently (if applicable): Don’t tie up too much cash in unsold goods.

Controlling Business Expenses

Here’s how to keep those expenses in check:

- Track all expenses carefully: Know where every dollar is going.

- Identify areas where you can cut costs: Are there any unnecessary expenses?

- Negotiate better deals with vendors: Don’t be afraid to ask for discounts.

- Avoid unnecessary spending: Do you really need that fancy office furniture?

Managing Debt and Credit

If your California LLC borrows money (takes on debt), it’s vital to manage that debt responsibly.

- Pay your bills on time to maintain a good credit score.

- Understand the terms of your loans.

- Avoid taking on more debt than you can handle.

Understanding Financial Statements

Financial statements are documents that tell the story of your LLC’s financial performance. You need to know how to read and interpret them to make informed decisions.

Reading and Interpreting the Balance Sheet

The balance sheet shows your LLC’s assets (what it owns), liabilities (what it owes), and equity (the owner’s stake) at a specific point in time. It’s like a snapshot of your LLC’s financial position.

Analyzing the Income Statement

The income statement (also called a profit and loss statement) shows your LLC’s revenue (income), expenses, and net income (profit or loss) over a period of time (like a month or year). It tells you whether your LLC is actually making money.

Understanding the Cash Flow Statement

The cash flow statement shows the movement of cash into and out of your LLC. It’s important for understanding your LLC’s liquidity (its ability to pay its bills).

Financing Options for California LLCs

If your California LLC needs extra capital to expand, buy equipment, or cover operating costs, there are various financing options available.

Exploring Small Business Loans

Small business loans are a common way to finance growth. You can get them from banks, credit unions, or online lenders.

Applying for Business Grants

Business grants are like free money – you don’t have to pay them back. However, they’re often competitive to get, and you’ll need to meet specific eligibility criteria.

Considering Alternative Funding Sources

Other funding sources for California LLCs include:

- Venture capital (for high-growth startups)

- Angel investors (wealthy individuals who invest in early-stage companies)

- Crowdfunding (raising money from a large number of people online)

Protecting Your LLC’s Assets: Financial Security and Risk Management

Protecting an LLC’s assets is absolutely essential for long-term financial security. You’ve worked hard to build your business, so you need to safeguard it. A crucial aspect of this protection involves understanding LLC liability protection in California. This legal framework shields members’ personal assets from business liabilities. However, comprehensive risk management extends beyond this legal structure.

Obtaining Business Insurance

Business insurance can shield your LLC from various risks, such as:

- Property damage (fire, theft, etc.)

- Liability (if someone sues your business)

- Business interruption (if you have to close temporarily)

Ensuring Legal and Regulatory Compliance

Staying compliant with all applicable legal and regulatory requirements in California is crucial. This includes things like:

- Obtaining necessary licenses and permits.

- Following employment laws.

- Adhering to consumer protection regulations.

Implementing Internal Controls and Fraud Prevention

Internal controls are procedures that you put in place to prevent fraud and ensure the accuracy of your financial records. This might include things like:

- Separating duties (so one person doesn’t control everything).

- Requiring multiple signatures for checks.

- Regularly reviewing financial statements.

Conclusion: Setting Your California LLC Up for Financial Success

Managing your California LLC finances might seem daunting at first. It’s a lot to learn, and there are definitely challenges. But with the right systems, knowledge, and support, you can absolutely set your business up for financial success.

By prioritizing accurate record-keeping, effective budgeting, and proactive financial planning, you’ll be well-equipped to navigate the ups and downs of business ownership. You’ll be able to make smart decisions, control your money, and build a thriving California LLC.

Author Bio

Fahad Rafi, Marketing Director at Business Rocket, shares insights on business formation and startup strategy to empower entrepreneurs. Connect with Fahad Rafi on LinkedIn.