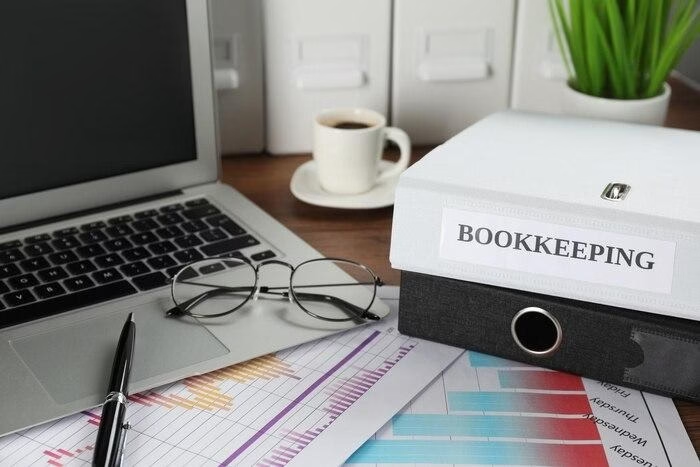

In a dynamic city like Fort Worth, precise bookkeeping is essential for a business’ success. The local professional services offer complete support in order to manage your finances in the right way while reducing the risks of error and also saving quality time. By outsourcing these services with local specialists the small and medium-sized businesses can benefit from clear reports, tax compliance and better financial planning. Therefore, choosing a trustable partner in this area means more than financial security, it means more freedom to focus on your business’ growth. If you want to know more about this subject, keep on reading and at the end of the article you will know if outsourcing these services is worth it.

What Is Fort Worth Bookkeeping and Why Is It Important?

Fort Worth Bookkeeping represents the process of recording, organizing and updating all a business’ financial transactions. It is the foundation of any solid financial system as it provides a clear picture of revenue, expenses and profitability. In this area where the market is very competitive and tax regulations can be complex, a well-structured system helps entrepreneurs make informed decisions and avoid legal problems.

One of the main advantages is maintaining accurate financial records where all transactions are documented, allowing for accurate analysis of the company’s performance. Besides, well-organized finances facilitate efficient tax preparation ensuring compliance with IRS requirements and reducing the risk of penalties. Also, having constant control over the cash flow makes the companies able to obtain improved cash flow management while also preventing liquidity difficulties.

The common errors in this field such as incorrect records, unpaid invoices or lack of supporting documents can seriously affect a company’s financial health. The collaboration with professionals in this industry can help you and your business to avoid these errors while offering accuracy, transparency and strategic support. This way the entrepreneurs can focus on the business’ growth having confidence that all financial aspects are managed correctly and efficiently.

Coursera also mentions ‘Bookkeeping is the systematic process of recording, organizing, and tracking all financial transactions of a business, including sales, purchases, payments, and receipts, to maintain accurate and up-to-date financial records that support business operations, tax reporting, and decision-making. While bookkeepers used to keep track of this information in physical books, much of the process is now done using software.’

What Do Bookkeeping Services in Fort Worth Include?

The bookkeeping services in Fort Worth are essential for maintaining clear evidence of the finances, precise and compliant with tax requirements. They cover a full range of activities designed to ensure total control over the finances of a business regardless of its size or field of activity.

The first and most important service is the preparation of accounting records and financial statements such as general ledger & financial statements which provide a complete picture of income, expenses and profit. Next there is managing accounts payable and receivable which maintains a balanced cash flow and avoids delays in payment or collection. Also, payroll processing is an essential service because it ensures the correct calculation of remuneration and tax contributions. Bank reconciliation ensures that all transactions are correctly recorded and aligned with bank statements.

In order to be prepared for taxes, these services include tax-ready financial reporting while providing complete and up-to-date documentation for tax returns. Besides, you can also benefit from a QuickBooks setup and support, facilitating digital accounting and quick access to real-time data.

By combining these bookkeeping services the entrepreneurs from Fort Worth benefit from accounting accuracy, time savings and a solid financial basis for strategic decisions.

Why Should You Choose a Local Business for Bookkeeping Services?

The professional services in this area offer essential support for the companies that want to maintain clear, organized and tax-compliant financial records. In a competitive economic environment such as this one well-managed finance is the key to the success and stability of a business.

With these services all financial transactions such as revenues, expenses, payments and receipts are recorded accurately and on time. The specialists in this industry ensure the preparation of financial records, bank reconciliation, payroll management and the development of financial reports necessary for strategic decision-making. And as a bonus they offer support for tax return preparation and financial process optimization that helps to avoid errors and ensure full compliance with IRS requirements.

Another major advantage of collaborating with local professionals is understanding the economic and fiscal specifics of the region which ensures personalized solutions for each business. Besides, the use of modern software such as QuickBooks allows for quick and secure access to updated financial data.

By outsourcing these services the entrepreneurs can save time while also reducing the intern costs of hiring an in-house department and they can focus on the real growth and development of their business. Therefore, choosing local financial services means precision, transparency and a solid base for financial growth in the long term.

CFI also mentions ‘Bookkeeping involves the recording, on a regular basis, of a company’s financial transactions. With proper bookkeeping, companies are able to track all information on its books to make key operating, investing, and financing decisions.Bookkeepers are individuals who manage all financial data for companies. Without bookkeepers, companies would not be aware of their current financial position, as well as the transactions that occur within the company. Accurate bookkeeping is also crucial to external users, which includes investors, financial institutions, or the government – people or organizations that need access to reliable information to make better investments or lending decisions. Simply put, business entities rely on accurate and reliable bookkeeping for both internal and external users.’

Conclusion

In conclusion, bookkeeping services ensure accurate financial records, proper transaction management and tax compliance. By collaborating with local specialists businesses save time, reduce the risk of errors and obtain clear reports for strategic decisions. By choosing local experts that know the market you optimize your bookkeeping while also protecting your business for the future.