Cryptocurrencies have matured from a niche experiment into a multi‑trillion‑dollar asset class, offering opportunities in payments, savings, and investment for anyone with an internet connection. At the same time, exchange hacks, phishing scams, and intrusive data collection have made many would‑be users hesitate, especially those who care about privacy and self‑custody.

This guide for dgmnews.com readers lays out a practical roadmap for how to buy cryptocurrency safely, how to exchange crypto quickly, and how to do so in a way that protects both funds and personal data. It also highlights how non‑custodial, registration‑free services such as StealthEX can help users move between assets or enter the market while keeping control of their keys and their identity.

Foundations of Secure Crypto

Before choosing any platform, it helps to understand a few core principles of crypto security that apply whether someone is a beginner or an intermediate user. Thinking in terms of custody, privacy, and transaction verification dramatically reduces the risk of loss or exposure.

At the center of crypto culture is the phrase “not your keys, not your coins,” which means that whoever controls the private keys ultimately controls the assets. In practice, this divides the ecosystem into custodial and non‑custodial services.

- Custodial services (most big centralized exchanges and some apps) hold users’ coins and keys on their own infrastructure, creating a single point of failure if the platform is hacked, freezes withdrawals, or goes bankrupt.

- Non‑custodial services help users transact wallet‑to‑wallet without ever taking long‑term possession of funds, so even if the service is compromised, attackers cannot drain user balances.

Privacy is the second pillar of secure crypto use, because transaction histories on public blockchains can often be linked to real‑world identities through exchange accounts, payment partners, or data brokers. Limiting what information is shared with each service and using privacy‑preserving tools where appropriate reduces the risk of stalking, targeted phishing, or financial profiling.

Finally, even the best secure crypto exchange cannot protect users who confirm the wrong details. Every on‑chain transaction is final, so addresses, networks, and amounts should be checked carefully before sending, especially when copying and pasting wallet addresses or switching between chains.

Custodial vs Non‑Custodial

Custodial exchanges function much like traditional brokerages: users deposit funds, the platform credits an internal balance, and trades happen inside the company’s database. This can be convenient for active traders but concentrates operational, regulatory, and counterparty risk in a single operator.

Non‑custodial platforms, by contrast, act as routing layers between user wallets and external liquidity sources, orchestrating swaps without creating long‑lived custodial accounts. With this model, coins move directly from a user‑controlled wallet to a destination wallet, and the service never holds an ongoing balance in the user’s name.

For users focused on security and sovereignty, non‑custodial solutions align more closely with the original design of networks such as Bitcoin, where control of keys equates to control of funds. They also reduce the personal data footprint because there is no need to maintain long‑term customer profiles or account records for simple swaps.

Why Privacy Matters?

Even when nothing illegal is happening, a fully transparent financial history can be a serious liability. Publicly tying every purchase, investment, or donation to a real‑name account exposes users to social engineering, extortion attempts, and unwanted commercial tracking.

Regulated exchanges that require full KYC (Know Your Customer) verification have legitimate compliance reasons, but the data they collect can become a target for breaches or misuse. Meanwhile, analytics tools can follow coins leaving these platforms, building detailed profiles of behavior and wealth.

Privacy‑conscious users often combine several strategies: using non‑custodial services, limiting KYC to situations where it is truly necessary, and occasionally making use of privacy‑focused assets such as Monero, Zcash, or Dash. This layered approach helps restore some of the discretion that has long been normal in cash transactions.

Double‑Check Every Transaction

Crypto protocols are unforgiving: if funds are sent to the wrong address or on the wrong network, there is usually no chargeback or customer‑service reversal. Many losses come not from sophisticated hacks but from haste and copy‑paste errors.

Before confirming any swap or transfer, it is wise to:

- Verify the first and last characters of the recipient address against what is displayed in the wallet or exchange interface.

- Confirm that the correct blockchain network (for example, native Bitcoin versus a wrapped token on another chain) has been selected.

- Start with a small “test” transaction when using a new service or sending to a new address, especially for large amounts.

These simple habits dramatically reduce the likelihood of irreversible mistakes, no matter which platform is used to exchange crypto.

Choosing a Crypto Exchange: Key Criteria

With thousands of platforms claiming to be the best fast crypto exchange, a simple checklist helps narrow down trustworthy options. For dgmnews.com readers who are already tech‑savvy, the main considerations typically fall into four categories.

- Security Model

- Does the platform operate as a custodial exchange that holds user balances in its own wallets, or as a non‑custodial router that performs wallet‑to‑wallet swaps only when requested.

- Are there clear explanations of how funds are stored, what happens during outages, and whether there is any insurance or incident history.

- Privacy Policy and KYC

- Some platforms require full registration and identity verification for any activity, while others allow small or crypto‑to‑crypto transactions without forcing KYC.

- Privacy‑first users should review what data is collected, how long it is stored, and whether the service allows no KYC crypto swaps under modest thresholds.

- Asset Variety and Liquidity

- A secure crypto exchange should support a wide spectrum of assets so users are not forced to open accounts on multiple platforms just to rebalance portfolios.

- For more advanced users, access to privacy coins, DeFi tokens, and emerging assets can be a deciding factor, especially when these are restricted on major custodial exchanges.

- Ease of Use and Support

- Clear interfaces, transparent fee displays, and straightforward flows reduce the chance of user error, particularly for beginners buying their first coins.

- Responsive support channels and public documentation are important when something goes wrong or a transaction is delayed.

Evaluating exchanges through this lens helps users find platforms that are both efficient and aligned with their security and privacy priorities.

StealthEX as a Private, Secure Crypto Swap Solution

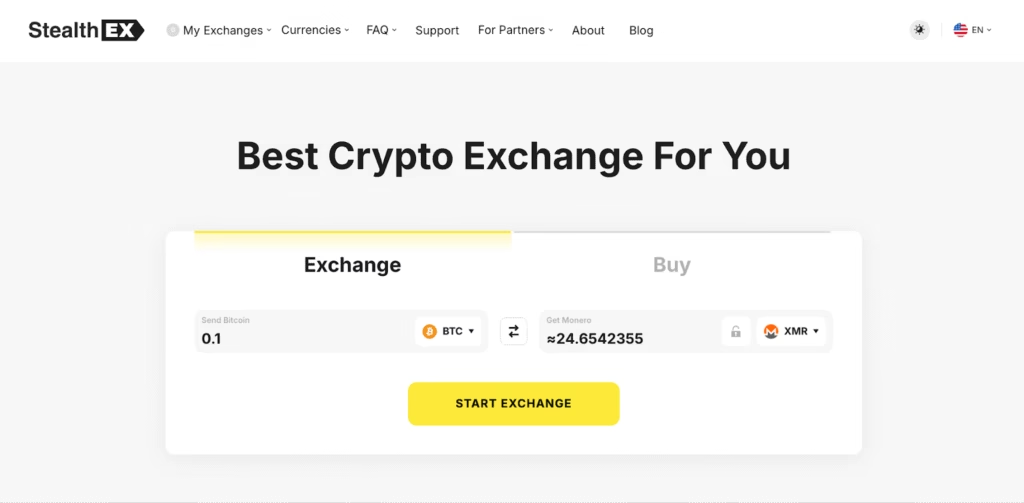

StealthEX is an example of a non‑custodial, instant cryptocurrency exchange built specifically for users who want fast swaps without sacrificing control or anonymity. Instead of asking users to deposit coins into platform‑managed wallets, each swap happens directly between a user’s sending wallet and a receiving wallet, with StealthEX coordinating the trade in the background.

Because the service is registration‑free, there is no need to create an account, store credentials, or upload identification just to move from one asset to another. For pure crypto‑to‑crypto swaps, StealthEX operates on a no‑KYC basis, which aligns well with users who want to exchange crypto while minimizing their digital footprint.

In terms of coverage, StealthEX supports over 2,000 cryptocurrencies, giving users broad optionality from blue‑chip assets like Bitcoin and Ethereum to niche altcoins and stablecoins. Crucially for privacy‑minded users, it also supports major privacy coins, including Monero, Zcash, and Dash, which are often restricted or delisted on large custodial venues.

For those looking to bolster their privacy, StealthEX provides a straightforward way to swap assets like Bitcoin for Monero, helping keep long‑term transaction histories away from centralized analytics. In practice, this makes StealthEX a natural fit for anyone who wants a private crypto exchange experience without the overhead of onboarding to yet another custodial platform.

Buying Crypto With Fiat, Without KYC

One of the biggest friction points for newcomers is the initial on‑ramp from traditional money into digital assets. Most large custodial exchanges and brokers require extensive KYC—uploads of identity documents, selfies, and proof of address—before allowing users to buy even small amounts of crypto.

StealthEX addresses this by integrating fiat payment partners so users can buy crypto with fiat (for example, via Visa, Mastercard, or bank transfer) directly through the interface. For modest orders, this process can often be completed without a full identity verification flow, making it significantly faster and less intrusive than traditional exchange onboarding.

In practice, users can typically buy cryptocurrency safely through StealthEX without mandatory KYC for amounts under roughly $700 or the equivalent in other currencies, with stricter checks only kicking in above that level. This makes the service an appealing entry point for beginners who want to test the waters with smaller purchases or for privacy‑aware users who prefer not to hand over full identity documents for low‑risk amounts.

Because the platform remains non‑custodial even when fiat is involved, purchased assets are sent directly to user‑controlled wallets rather than parked indefinitely on a centralized ledger. That design keeps the on‑ramp experience aligned with the broader self‑custody best practices discussed earlier.

Step‑by‑Step: Performing a Swap on StealthEX

To illustrate how a fast crypto exchange can stay simple while remaining non‑custodial and private, consider the four basic steps of a StealthEX swap. The flow is designed to be understandable even for first‑time users.

- Select the Cryptocurrency Pair and Amount

Choose the asset to send (for example, Bitcoin) and the asset to receive (for example, Monero), specify the amount, and review either a fixed or floating rate quote. - Provide the Recipient Wallet Address

Enter the address where the received coins should be delivered, ensuring it matches the correct asset and blockchain network (for instance, a valid Monero address for XMR). - Confirm Details and Send Funds

Double‑check the amounts, addresses, and rates, then send the specified amount from the user’s wallet to the deposit address generated by StealthEX. - Receive the New Coins in Your Wallet

Once the swap completes, the exchanged coins are delivered directly to the recipient wallet, with no need to withdraw from a custodial account or wait for manual approval.

This straightforward sequence helps users exchange crypto quickly while maintaining full control of both the source and destination wallets at every step.

Putting It All Together

For anyone exploring how to quickly and safely buy and exchange cryptocurrency, the central themes are self‑custody, careful platform selection, and respect for financial privacy. Understanding the difference between custodial and non‑custodial services, verifying every transaction, and keeping personal data exposure to a minimum go much further than chasing the latest hype coin.

Services like StealthEX demonstrate that it is possible to combine speed and ease of use with a non‑custodial, registration‑free, privacy‑first architecture that supports everything from mainstream assets to privacy coins such as Monero, Zcash, and Dash. With support for more than 2,000 cryptocurrencies and the ability to buy crypto with no KYC for smaller amounts, it offers a practical toolkit for both new and intermediate users looking to take control of their digital wealth.As the crypto landscape continues to evolve, the most resilient strategy is to treat security and privacy as first‑class requirements rather than afterthoughts. By favoring non‑custodial tools, doing independent research, and choosing platforms that respect user sovereignty, such as StealthEX, crypto holders can build a safer, more private path into the digital asset economy.