Crypto taxes shape what you actually earn from every trade. This guide distills the essentials: when activity becomes income or capital gains, how cost basis and fees shape results, and how price volatility affects reporting, so you can plan ahead, minimize surprises, and file with confidence.

Do you owe taxes on crypto?

Crypto may look like digital cash, but tax offices don’t see it that way – they treat it as property. That means you can trigger a taxable event even without cashing out to fiat. If you sell a token for more than you paid, swap one coin for another, or spend crypto on goods, you may owe tax on crypto gains. The exact outcome depends on your holding period, local rules, and the records you keep. The key point: crypto isn’t automatically tax‑free just because it lives on‑chain; what matters is whether a transaction created a gain or income.

Every country handles crypto taxes in its own way, but the logic stays the same: if a transaction changes your wallet’s value, it probably needs to be reported. Buy-and-hold usually isn’t taxable until disposal; staking or mining is typically income at receipt, with capital results on later disposal. Because prices move fast, keep clear, dated records of lots, fees, and wallets to defend your numbers and optimize outcomes.

Which crypto activities trigger income vs. capital gains?

Before you ask “how much is crypto taxed?,” pin down whether an action creates income (taxed at ordinary rates) or a capital gain/loss (taxed when you dispose of the asset). Common scenarios include:

- Selling for fiat: generally a capital gain or loss based on your cost basis.

- Swapping one coin for another: usually a taxable disposition of the asset you gave up.

- Spending crypto on goods/services: In most cases, a sale of crypto at its fair market value at checkout.

- Earning through staking, mining, or airdrops: often ordinary income at receipt, later disposal can create capital gains or losses.

- Receiving crypto as salary or business revenue: ordinarily taxed as income, subsequent sales trigger capital results.

Rates and timing differ: income is taxed when received; capital gains at disposal. Long-term (over a year) is often more favorable than short-term, so dates matter.

DeFi adds nuance. Moving tokens into a non‑custodial wallet is usually not taxable by itself, but certain liquidity pool deposits, claimable rewards, or token swaps can trigger events. If a protocol issues a new governance token in exchange for your activity, many tax offices view that as income at market value. Later, when you sell or swap that token, the capital calculation begins from that recognized basis.

How to calculate cost basis and capital gains

Keeping good records makes filing easier – and can cut your bill on taxes on crypto. Your cost basis is the purchase price plus fees. When you sell, your capital gain (or loss) equals proceeds minus cost basis. Holding for more than a year is often treated as long‑term, which may qualify for lower rates than short‑term holdings.

Example: 1 BTC ≈ $101,930, so 0.5 BTC ≈ $50,965. With a 0.5% exchange fee (~$255), spot purchase commissions typically range 0.1%–1% and may include the Bitcoin network fee and other charges, your cost basis is ≈ $51,220 (excluding any network fee). If you later sell for $54,000, your capital gain is ≈ $2,780. If you instead swapped into another coin, the same math applies at the token’s fair market value on the swap date.

Accounting methods like FIFO, LIFO, or specific identification determine which units you sold and can change your result, if you can substantiate the lots with transaction hashes, exchange statements, and wallet records.

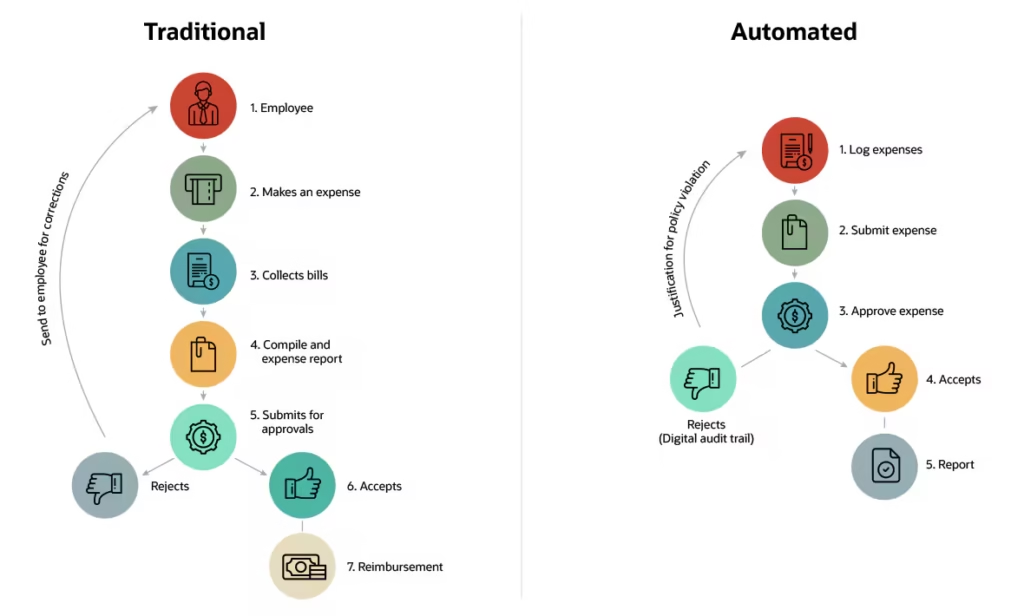

Deadlines and forms vary, but the workflow is similar everywhere: gather wallet addresses and exchange exports, reconcile transfers so you do not double‑count, classify income versus capital events, apply your accounting method consistently, and retain evidence. Exchanges that seek to operate lawfully and avoid regulatory issues submit client trading data to tax authorities. Trying to conceal such income can result in penalties and interest. One prominent example is Coinbase. And if you are wondering is Coinbase good, note that Coinbase closely cooperates with U.S. tax agencies.

Solid documentation today makes next year’s filing easier, and understanding how is crypto taxed empowers you to plan ahead, reduce surprises, and stay compliant as the market evolves.