Managing business expenses used to mean piles of receipts and long hours with spreadsheets. Modern tools make expense tracking faster and easier for everyone. If you are trying to understand what today’s tools can do, this guide is for you.

- Smart Receipt Capture

Smart receipt-capture systems are huge time-savers. Employees take a picture of a receipt with their phone, and the system reads the details and fills them in. These features reduce manual data entry and make tracking expenses much easier.

- Automatic Expense Categorization

As you are probably aware, manually sorting receipts is time-consuming and could lead to more mistakes down the line. Instead of focusing on how users capture and submit expenses, companies such as Clyr focus on what happens after: many tools now use ai powered expense management software to learn spending habits over time. The more you use it, the smarter it gets.

- Current Expense Support

There’s no need to wait until the end of the month. With current expense support, managers can see spending in real time, track spending trends, and have finance teams identify concerns. This supports budget control and helps them make decisions more quickly.

- Simple Policy Rules and Alerts

There’s a reason expense policies exist, but they can be hard to enforce. Newer systems implement rules autonomously. If there’s a procedure violation, the expense policy is flagged. Employees receive alerts with instructions before submitting. This increases adherence to the expense policy and reduces the need for awkward conversations afterward.

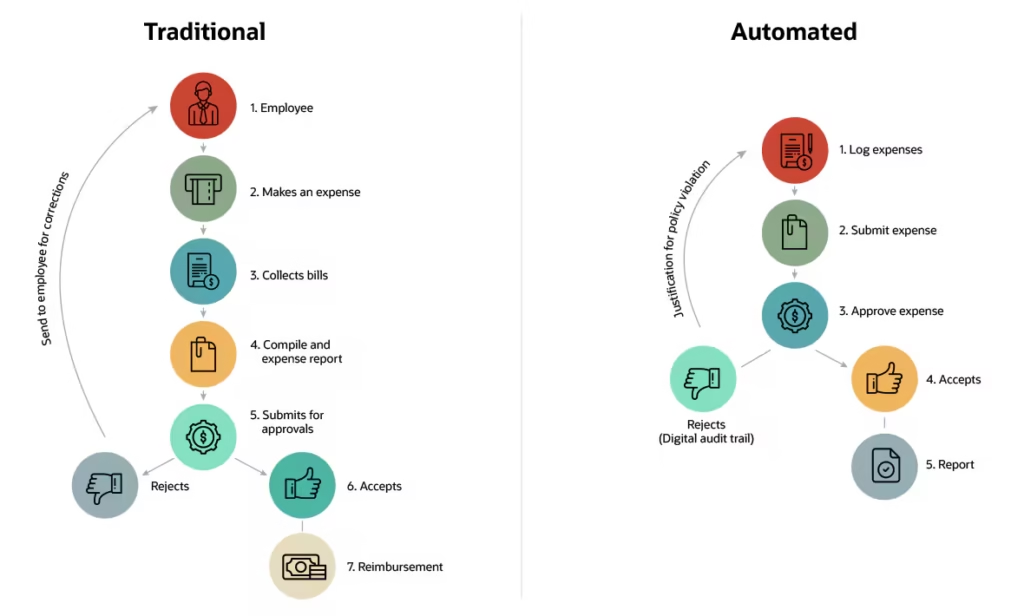

- Rapid Approval Workflows

Approvals can be a long, drawn-out process. Newer systems enable managers to approve expenses with a click, even on their phones. Workflows outline who needs to approve expenses and when. This streamlines expense approval workflows and keeps repayments on track.

- Fast and Clear Refunds

Waiting for refunds can quickly frustrate employees. When people pay for work expenses out of their own pocket, they expect to be repaid on time. Delays cause stress and can hurt trust. Modern expense systems fix this problem. They connect directly with payment and payroll tools. Once a manager approves an expense, the refund process begins immediately. There is no need for extra emails or follow-ups.

- Simple Reports Everyone Can Understand

Expense reports should help people, not confuse them. Older systems often produce long tables filled with numbers. These are hard to read and easy to ignore. Modern systems do things differently. They turn raw spending data into simple reports. You can see where money goes by team, category, or time period. Charts and graphs make trends easy to spot at a glance.

For example, you can quickly see if travel costs are rising or if one department is overspending. This helps leaders make better decisions without having to dig through spreadsheets. Clear reports also support better planning. Finance teams can control costs, managers can adjust budgets, and business owners can see the full picture without extra effort.

- Integration with Other Tools

No system should operate in isolation. Modern expense management tools integrate with accounting tools, payroll systems, banking feeds, and other software to reduce manual entry and unsynchronized records. Good software integration saves time and reduces mistakes.

- Mobile Friendly Design

Mobile expensing is modern. Employees can submit expenses and receive approvals on the fly. Other employees can submit and receive approvals on the fly. Mobile design keeps the process flowing and improves user engagement.

- Secure Data and Audit Trails

Financial tools need to have good data protection features and clear audit trails. Modern tools log every change and track it so you can have an audit and trust the tool.

Why These Features Matter Together

Together, these features help transform how companies deal with expenses. Manual processes and errors decrease, so the visibility increases. Overall, companies can reduce administrative work and refocus on the important work. This is the reason many businesses leave simple systems behind and start using better expense management tools.

How to Pick the Right System

Not every system works for every business. Make a list of your biggest challenges. Are there delays with approvals? Missing receipts? Insufficient clarity? Pick a system that helps address those. Simplicity is important too. A useful, simple system is better than a complicated one that gets no usage.

Smarter Expense Management Starts Here

Modern expense management systems are created to save time, decrease stress, and improve managerial control. With the appropriate components, disorganized systems become streamlined. Tools designed to help businesses become more efficient, rather than harder.

If your systems are running slowly and are outdated, it is time to upgrade them. The best components do more than manage expenses. They positively transform the way your business operates.