Adelaide homeowners know the struggle of protecting their vehicles from harsh sun, unpredictable weather, and potential damage. With summer temperatures soaring and occasional hailstorms threatening your investment, a carport becomes more than just a convenience—it’s a necessity. However, many families hesitate to move forward with carport installations due to upfront costs, not realizing that various financing options can make this valuable addition surprisingly affordable.

Understanding the Benefits of Installing Carports in Adelaide

Before exploring financing solutions, it’s important to understand why carports in Adelaide represent such a smart investment for your property. Adelaide’s climate presents unique challenges that make vehicle protection essential year-round.

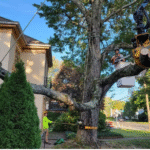

The scorching summer sun can fade paint, crack dashboards, and make your car uncomfortably hot. During winter months, morning frost and occasional severe weather can damage exterior surfaces. A well-designed carport shields your vehicle from these elements while adding significant value to your property.

Beyond vehicle protection, carports provide versatile outdoor spaces for entertaining, storage, or workshop activities. Many Adelaide families discover their carport becomes a multi-functional area that enhances their lifestyle while protecting their automotive investments.

Exploring Financing Options for Your Carport Project

Premium Home Improvements projects don’t have to strain your budget when you understand the available financing pathways. Several options exist to help Adelaide homeowners manage carport installation costs effectively.

Personal loans offer one of the most straightforward approaches. Many banks and credit unions provide competitive rates for home improvement projects, allowing you to spread payments over manageable terms. These loans typically feature fixed interest rates, making budgeting predictable.

Home equity loans present another attractive option for homeowners with established equity. Since carports add property value, using existing equity to finance the project often makes financial sense. The interest may also be tax-deductible, though you should consult your accountant for specific advice.

Some contractors offer in-house financing programs specifically designed for carports in Adelaide installations. These programs often feature promotional rates or deferred payment options that can significantly reduce initial financial pressure.

Government Grants and Rebates for Carport Installations

South Australian homeowners may qualify for various government incentives that reduce carport installation costs. The state government occasionally offers rebates for home improvements that increase property values or enhance energy efficiency.

Solar carports, which combine vehicle protection with renewable energy generation, may qualify for additional federal solar rebates. These installations serve dual purposes—protecting your car while generating clean electricity for your home.

Local councils sometimes provide grants for home improvements that meet specific criteria. Contact your local Adelaide council to inquire about current programs that might apply to your Premium Home Improvements project.

How to Choose the Right Financing Option

Selecting the best financing approach depends on your personal financial situation, timeline, and long-term goals. Start by evaluating your current cash flow and determining comfortable monthly payment amounts.

Compare interest rates across different financing options. While personal loans might offer quick approval, home equity loans often provide lower rates for qualified borrowers. Consider the total cost over the loan term, not just monthly payments.

Think about your timeline. Some financing options provide immediate access to funds, while others require longer approval processes. If you need your carports in Adelaide installation completed before summer arrives, factor processing time into your decision.

Examine any additional fees or penalties associated with different financing options. Some loans include origination fees, while others might charge penalties for early payoff.

Conclusion

Quality carports in Adelaide don’t have to remain out of reach due to budget constraints. With proper planning and the right financing approach, most homeowners can access the vehicle protection and property enhancement they need.

Start by obtaining detailed quotes from reputable contractors specializing in Premium Home Improvements. Understanding total project costs helps you select appropriate financing amounts and terms.

Consider the long-term value proposition. While financing adds interest costs, the property value increase, vehicle protection benefits, and enhanced lifestyle often justify the investment. Many homeowners find their carport pays for itself through reduced vehicle maintenance costs and increased property appeal.