Manufacturers have invested heavily in optimizing material flow, production schedules, and logistics networks, yet one of the most fragile links in the supply chain remains the workforce itself. Labor shortages, rising absenteeism, and high turnover continue to disrupt output, even in well-equipped facilities. Increasingly, these challenges are tied not only to wages, but to how and when workers are paid.

Let’s take a look at how manufacturing payment platforms that provide access to earned wages can help reshape workforce stability, safety, and operational performance across the supply chain.

Solving the Manufacturing Labor Gap

Manufacturing leaders are recognizing a direct connection between employee financial stress and downtime on the factory floor. When workers struggle to bridge the gap between pay cycles, attendance and reliability often suffer, regardless of hourly rates. Traditional payroll structures can unintentionally contribute to this problem by limiting access to earned wages.

Key ways a manufacturing payment platform can help address the labor gap include:

- Reducing absenteeism caused by short-term cash flow emergencies that prevent workers from making it to a shift

- Limiting no-shows by new hires who disengage before their first or second paycheck

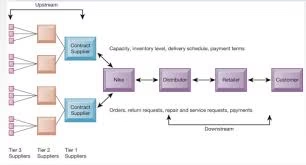

- Reframing labor as a critical supply chain input that requires the same level of risk management as materials and equipment

By stabilizing the human side of operations, manufacturers can reduce unexpected disruptions that ripple through production schedules.

Strategies for Reducing Turnover in High-Volume Production

High-volume manufacturing environments are particularly susceptible to churn, especially during onboarding. Early financial pressure can push workers to leave for roles that offer faster access to pay, even if the work itself is comparable.

Effective retention strategies supported by manufacturing payment platforms include:

- Leveraging the motivational effect of immediate access to earned pay to improve shift attendance

- Breaking the job-hopping cycle by offering financial flexibility that competing employers may not provide

- Supporting employees during the first 90 days, when turnover risk is highest and training costs are sometimes still being recovered

These approaches help plants protect their investment in hiring and training while building a more dependable workforce.

Enhancing Operational Safety and Efficiency

Financial stress can also affect how employees perform on the job. Workers who arrive distracted by financial concerns may be physically present but less focused, increasing the risk of errors or safety incidents. Over time, this kind of financial presenteeism can lead to higher incident rates, rework, and compliance challenges.

By improving access to earned pay, manufacturers can help employees stay focused and engaged during shifts. Payment platforms also make it easier to offer timely incentives for overtime or hard-to-fill shifts, ensuring staffing gaps are addressed without delaying compensation. Importantly, some tools integrate into existing payroll workflows, minimizing additional admin for HR and finance teams.

Optimize Your Operations with a Manufacturing Payment Platform

Legacy payroll systems were designed for a different workforce with more predictable work schedules and different financial pressures. Industrial employees now expect tools that align with their needs, especially in environments where shifts, overtime, and variable hours are common.

Start exploring how a manufacturing payment platform can integrate with your existing payroll system to close gaps between pay cycles and help reduce labor disruptions that affect the supply chain.