The online payment environment is undergoing significant changes, driven by the growing demand for speed, security, and convenience. The card-based transactions that were the foundation of online transactions are being slowly replaced by more direct approaches that do not rely on intermediaries.

Among them, pay by bank allows for immediate bank-to-bank payments without using traditional payment processors. It enables greater security measures, lowers the cost of transactions and decreases the possibility of unsuccessful payments.

Consumers are increasingly gaining trust in their banks over third-party platforms, offering businesses an opportunity to boost conversion rates and provide a seamless payment process. The ease, confidence and efficiency of the bank-initiated payments make them a game changer in the future of digital transactions.

With the changing environment in the payments ecosystem, it is important to learn how pay by bank is transforming the online environment. In this article, we discuss the mechanics, advantages, and prospects of online payments.

The Mechanics Of Pay By Bank

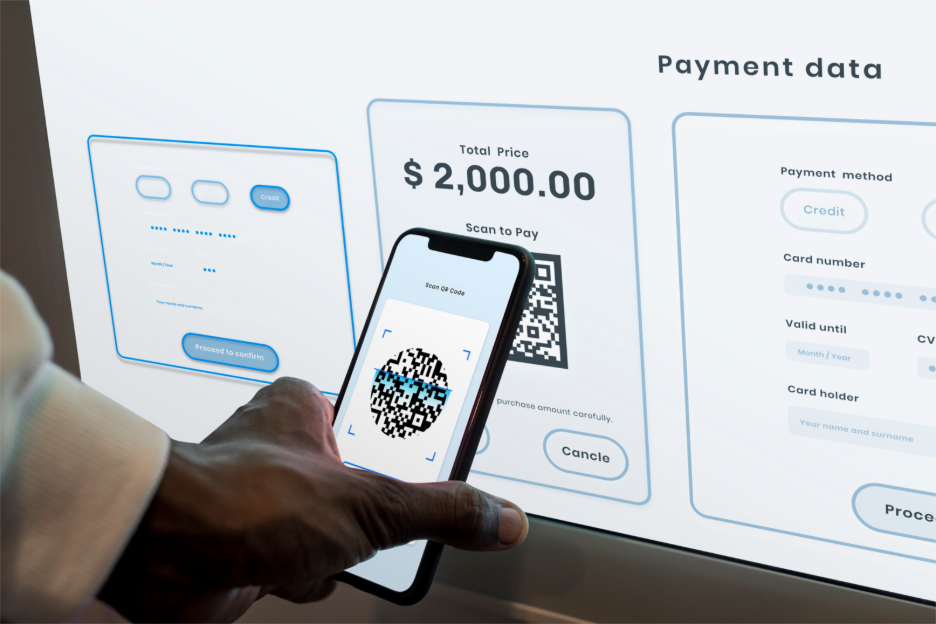

Pay by bank utilizes established banking facilities to make payments directly from a customer’s account. In comparison to the old card systems, where the request is transmitted through multiple parties, pay by bank directs the payment request directly to a bank, and the money is transferred almost instantly.

It is normally done by generating a payment request and forwarding it using a secured link, customer authentication using the banking application, payment confirmation, and instant transfer to the recipient account.

With the incorporation of such systems, businesses will eliminate the delays and errors associated with card declines, expired dates, or insufficient funds, which tend to lower revenue and customer satisfaction.

How Pay by Bank Is Changing the Future of Online Payments

The increasing trend of direct bank payments is more than a technological advancement; it is a significant alteration of the flow of money over the Internet.

The sections below discuss the major transformations that pay by bank is causing in the world of payment, both to businesses and consumers.

1. Security And Compliance Advantages

Direct payments made to the bank offer more security than most traditional ways of online payments. The authentication will be performed using the customer’s bank, which should have multi-factor security protocols in place.

As the data on payments is never stored in a merchant’s system, the potential risks linked to data breaches are significantly reduced.

Additionally, the solutions will be structured to comply with international payment rules, including PSD2, ensuring that buyers and sellers operate in a safe and compliant environment.

The use of accepted banking systems makes more consumers confident and trust in online transactions.

2. Cost Efficiency For Businesses

Traditional card processing charges can be a significant cost to a firm, sometimes reaching high percentages of the transaction value. Pay by bank helps minimize such costs by eliminating intermediaries.

Direct bank transfers may incur a small, fixed fee, and instant settlement ensures that money is available immediately, thereby enhancing cash flow. In the case of high-transaction-volume businesses, a direct bank payment solution can result in saving thousands of dollars every year.

In addition to saving costs, pay by bank increases the efficiency of the operations and simplifies the management of payments. This efficiency will be beneficial to both the businesses and the customers, as the payment experience will be more relaxed and trustworthy.

3. Reducing Payment Failures

Declined cards or expired information that results in failed payments can greatly impact revenue. Pay by bank assists businesses in reducing such concerns, as the customer is in a position to authenticate payments using their banking credentials.

This real-time verification ensures that there are sufficient funds and that it also verifies the identity of the customer, which guarantees an increase in the rate of success in the transaction.

Improving payment success not only guarantees revenue but also improves customer experience. The ability to offer a smooth and efficient payment procedure allows businesses to have more trust and loyalty towards their customers.

Pay by bank is a useful solution to the current online transactions because it is efficient and reliable.

4. Consumer Trust And Behavioral Shifts

The payment methods that are viewed as safer and more transparent are becoming the preferred method of customer behavior.

Research has indicated that most consumers would use direct bank transfers compared to providing card information to online traders. Pay by bank capitalizes on this trust, as a familiar environment for users.

With an included system that enables familiar banking habits, businesses will be able to convert potential buyers. Pay by bank will also aid in developing long-term loyalty among customers, in that the payment procedure will be smooth and reliable.

5. Integration And Accessibility

Bank solutions for modern pay are made to be easy to integrate. APIs also enable companies to integrate with a variety of banks in parallel, which makes implementation easier. It can be set up in just a few minutes without needing a complex merchant account or a lengthy approval process.

Both mobile and desktop platforms are supported, making payments available to a wide audience, regardless of the device one prefers to use.

In addition, the recurring deposit and tracking of transactions are useful features that increase the productivity of the business dealing with subscriptions or continuous services.

Challenges And Considerations

Despite the merits of pay by bank, there are challenges to adoption. Merchant systems should be able to work with various banks and adhere to the regulatory requirements in multiple jurisdictions.

Education to consumers is significant, as some of them may be unwilling to make payments of new types. In addition, the technology must be capable of fraud detection and customer support to solve exceptions.

The collaboration of fintech providers, banks, and regulators is required to eliminate these problems and to create an efficient and stable ecosystem.

The Future Of Online Payments

The trend of online payment shows a shift to methodologies focused on speed, security, and trust. The pay by bank reflects these values in making direct and authenticated bank transfers without any intermediaries.

With the spread of e-commerce and shoppers’ desire for smoother payment systems, the bank-based transaction is expected to gain increasing dominance, complementing but ultimately competing with the traditional card system.

As the adoption of pay by bank increases worldwide and more financial infrastructure is developed, it can make cross-border transactions easier and transform online trade globally.

By implementing these solutions early on, businesses will gain access to low costs, increased conversion rates, and loyal customers. Consumers will also have better, more convenient access to their payments and be more confident that it is secure.

Bottomline

Pay by bank is transforming the digital payment landscape by integrating security, efficiency, and consumer trust. Direct bank transfers offer companies improved cash flow, reduced payment failures, and lower processing costs. Consumers appreciate familiar, verified transactions and feel secure with their sensitive information.

As more users adopt pay by bank, it will probably become a foundation of online transactions by making them quicker, safer, and more trustworthy.

The approach of making payments directly to the bank is a significant step in creating a smooth and reliable financial environment between businesses and consumers.