Paying off your debt is a huge achievement—congratulations! But the road to financial stability doesn’t end there.

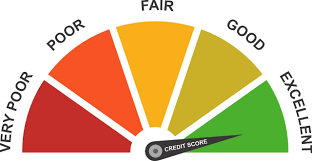

One of the most important steps you can take after resolving your debt is to work on rebuilding your credit score. A healthy credit score opens doors to greater financial opportunities, from better loan terms to lower insurance premiums.

This guide will show you actionable steps to improve your credit score, avoid common pitfalls, and maintain your financial progress—while emphasizing how Cero Deuda can provide support as you move forward.

Why Rebuilding Your Credit Score Matters

A good credit score isn’t just a number—it’s a reflection of your financial health and trustworthiness. It impacts your ability to secure loans or credit cards at favorable terms, and can even influence rental applications or job opportunities.

Paying off debt is a significant milestone, but it may have affected your credit history in several ways:

- Late Payments: Previous late or missed payments might still appear on your credit report.

- High Utilization History: If you carried large balances in the past, this could lower your score.

- Account Closures: Accounts closed during debt repayment could reduce your available credit, affecting your overall score.

Rebuilding your credit score tells future lenders that you’re financially responsible and committed to maintaining good credit habits.

Steps to Improve Your Credit Score After Debt Resolution

1. Review Your Credit Reports

Start by requesting a free credit report from major credit bureaus (Experian, Equifax, and TransUnion in the U.S.). Examine the reports carefully for inaccuracies, such as incorrect late payments or accounts that were not updated to reflect your debt resolution.

If you find errors, dispute them directly with the credit bureau. Correcting inaccuracies can have an immediate positive impact on your score.

2. Build a Positive Credit History

Having a clean slate is great, but lenders also want to see evidence that you can responsibly manage credit. Rebuilding depends on creating new positive activity on your credit file.

- Secured Credit Cards: Consider applying for a secured credit card, which requires a small cash deposit. Use it for small, manageable expenses and pay off the balance in full each month to demonstrate reliability.

- Credit-Builder Loans: These small loans are designed for people rebuilding credit. Payments are reported to credit bureaus, helping to boost your score.

3. Pay All Bills on Time

Your payment history accounts for 35% of your credit score, so making consistent, on-time payments is crucial. Set up payment reminders or enroll in autopay to ensure you never miss a due date.

Pro tip: Even small bills like utility payments can often be reported to credit bureaus, adding more positive activity to your file.

4. Reduce Credit Utilization

Credit utilization—the percentage of your available credit that you use—plays a significant role in your score. Aim to keep your utilization below 30% of your total credit limit. If possible, pay off balances in full each month to build a strong credit profile.

5. Avoid Taking on New Debts

It might be tempting to open multiple new lines of credit, but this could hurt your score in the short term. Too many hard inquiries from credit applications can signal financial instability to lenders. Be selective and strategic about applying for new credit.

Common Mistakes to Avoid When Rebuilding Credit

While you work on improving your credit score, be mindful of these common pitfalls that can derail your progress:

- Closing Old Accounts: Even if you’re no longer using old credit cards, keep them open (unless they have high fees). The longer your credit history, the better your score.

- Overspending on New Credit: Resist the urge to accumulate unnecessary debt. Stick to a budget and use credit only for planned, manageable expenses.

How Cero Deuda Helps You Achieve Financial Stability

At Cero Deuda, we understand that financial recovery doesn’t stop at resolving debt—it’s about building a stable, prosperous future. Here’s how we support our clients in their financial journeys:

- Expert Guidance: Our team provides personalized advice tailored to your unique situation, helping you rebuild your credit while maintaining financial stability.

- Proven Strategies: We offer solutions like our debt resolution program to help clients settle debts quickly and efficiently.

- Real Success Stories: Join the thousands of clients, like Angie G. and Julio C., who turned their financial situations around with our support.

Looking for additional resources or personalized financial stability solutions? Visit Cero Deuda to book your free consultation.

Reclaim Your Financial Freedom

Rebuilding your credit score takes time and commitment, but the benefits are well worth the effort. By following these steps and avoiding common mistakes, you can establish financial stability and enjoy the opportunities that come with a strong credit profile.

If you’re ready to take control and need expert guidance, reach out to Cero Deuda today. Together, we’ll build a brighter financial future—starting now.

Visit Cero Deuda to learn more about our services and schedule your free consultation today!