Are you looking for a smart way to finance multiple investment properties in California and without the need to be burdened by the traditional loan requirements?

The answer is DSCR or Debt Service Coverage Ratio loans. Real estate investors can use rental income instead of personal income, so acquiring and managing properties will be easier and far more efficient.

This blog is on the DSCR loan-working mechanism, its benefits, and how to use DSCR loans in California to finance multiple investment properties. It emphasizes no down payment options, down payment requirements, and commercial DSCR loans.

Why Choose DSCR Loans in California?

DSCR loans are gaining popularity because of flexibility and can be very accessible for real estate investors. Definitely one of the most inviting rental markets in the U.S., California has an inventory characterized by permanently rising demand that fuels value appreciation in the property.

As DSCR loans do not depend on traditional income verification, these are attractive for self-employed or borrowers with complex financials. DSCR loans have many lenders that have recently streamlined the approval process, making it possible for clients to close faster.

Being able to scale quickly and finance multiple properties, it’s pretty simple to see why many investors like DSCR loans.

What are the Basic Requirements of a DSCR Loan?

Before getting into strategies, there are also some basic requirements for getting a DSCR loan in California that are worth mentioning:

- Minimum DSCR: Most lenders require at least a minimum DSCR of 0.75, while a ratio of 1.2 or more is recommended for even cash flow.

- Credit Score: Traditionally, most financiers require that their credit score be at least 620.

- Down Payment: Conventional loans demand that a minimum of 20% down payment be made, although no down payment DSCR loans may be permitted in certain situations.

- Appraisal Property: Appraisal is meant to establish the market value and the average potential of the property for rental purposes to meet loan requirements.

How to use DSCR Loans in California to fund multiple investment properties?

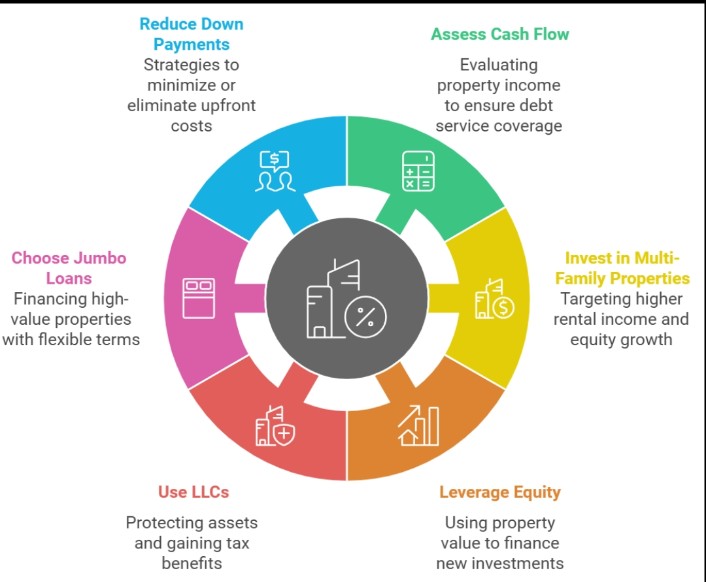

1. Assess Cash Flow from Property

First, when receiving a DSCR loan, it is essential to assess the property’s cash flow potential.

Estimate Anticipated Rental Income: Estimate with data from the market and take conservative estimates to account for vacancies.

Add project expenses that include taxes, insurance, and maintenance fees.

Calculate DSCR using the following formula:

DSCR = NOI Divided by Total Debt Service

- Net Operating Income (NOI): The income generated from operating a business after deducting operating expenses, but before accounting for taxes and interest payments.

- Total Debt Service: The total amount required to repay a loan, including both the interest and principal components.

If DSCR is over 1.2, the property can well support its debt service, which is a suitable investment.

2. Invest in Multi-Family Properties

Multi-family property investments in two to four units have these benefits:

- Increased Rental Income: Multifamily properties yield higher rental income for every dollar of equity invested compared to single-family homes.

- Lower down payments: Multifamily properties have much smaller down payments in contrast with their income-generating ability when funding them.

- Equity Build-up: Multi-family properties help investors to build equity faster, thus enabling quicker portfolio growth.

3. Leveraging Equity for More Investments

Once your properties have appreciated or brought in constant income, you can use this equity to finance new investments.

- Refinancing Strategy: Using the equity developed in existing properties to fund new ones means that you are not going to require much initial cash.

- Cash Out Refinancing: Cash-out refinancing is mainly accessible with the lender, and you can avail of the funds raised for further investing in real estate.

4. Use LLCs to Protect Your Assets

Keeping the assets under an LLC provides:

- Asset Protection: An LLC protects personal assets against liabilities associated with property ownership.

- Tax Benefits: Business Expenses like property management and maintenance may be included.

- Credit Flexibility: Loans done under an LLC will not appear on personal credit; you can retain your credit rating for upcoming investments.

5. Improve Financial Management

Effective financial management is important for maximizing the benefits of DSCR loans. Investors can:

- Maintain Accurate Records: Keeping detailed financial records helps in calculating NOI accurately, which is essential for determining DSCR.

- Monitor Operating Expenses: Regularly review and manage operating expenses to ensure they remain low, thereby increasing NOI.

How to Reduce or Avoid Down Payments?

Though most DSCR loans demand a 20% down payment, there are some strategies you can apply to minimize or avoid a down payment.

- Negotiate Terms: Some lender options might offer no down payment DSCR loans on properties with unusually strong cash flow.

- Cross-Collateralization: Use other equity as the underlying for cross-collateral, meaning the down payment can be decreased or eliminated.

- Co-Investments: Partner with other investors to share the burden of the down payment and pool the investment.

How to Find the Best DSCR Lenders?

A lender needs to be selected to obtain the best terms. Look for lenders specializing in commercial DSCR loans or bringing a new solution, such as no down payment on a DSCR loan. A fast and reliable source of financing is essential in the competitive California real estate market, so you want to select a lender that has a proven track record in DSCR loans.

Munshi Capital is the best, one of the top lenders when you talk about DSCR loan financing, and what they have done so far has earned them an excellent reputation for their expertise.

They mainly focus on property cash flow to ensure investors get the best options to build up their portfolios. A simplified approach with competitive terms could ultimately make real estate investors in California choose them as their go-to source of financing.