In today’s digital world, businesses are constantly seeking efficient, secure, and cost-effective payment solutions to enhance their operations and cater to a global customer base. MoneyCollect and local payment systems are at the forefront of this transformation, offering robust alternative payment methods that can streamline transactions and expand market reach. This article delves into how MoneyCollect and local payment methods are shaping the future of financial transactions.

Understanding MoneyCollect

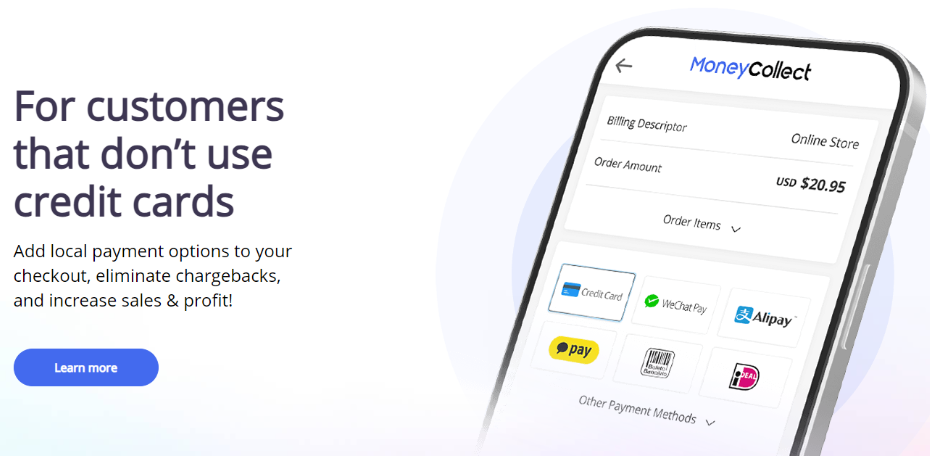

MoneyCollect is a comprehensive payment platform that enables businesses to accept payments from customers worldwide. It stands out as a pivotal player in the alternative payment methods landscape, providing a versatile solution that supports multiple currencies and payment types. MoneyCollect is particularly beneficial for e-commerce businesses, allowing them to manage transactions efficiently and securely.

Key Features of MoneyCollect:

- Multi-Currency Support: MoneyCollect allows transactions in various currencies, offering flexibility for international customers.

- Security: Enhanced security features ensure that both businesses and their customers are protected against fraud.

- User-Friendly Interface: Easy integration and a straightforward interface make MoneyCollect an excellent choice for businesses of all sizes.

The Role of Local Payment Methods

Local payment methods refer to payment options that are typically preferred in specific regions or countries. These can include bank transfers, e-wallets, cash-based methods, and more. Integrating local payment methods into a business’s payment system allows for a more inclusive approach, accommodating customers’ preferences and increasing conversion rates.

Benefits of Local Payment Methods:

- Increased Customer Trust: Customers are more likely to trust and use payment methods that are familiar and widely accepted in their region.

- Higher Conversion Rates: Offering preferred local payment options reduces cart abandonment and enhances the likelihood of purchase completion.

- Localized Experience: Tailoring payment options to fit local practices and currencies can significantly enhance the customer experience.

How MoneyCollect Integrates with Local Payment Systems

MoneyCollect excels by integrating local payment methods into its platform, thus bridging the gap between global businesses and local markets. This integration allows businesses to offer a personalized payment experience to customers, regardless of their geographic location.

Integration Benefits:

- Seamless Transactions: Customers enjoy a smooth and uninterrupted checkout process using their preferred payment method.

- Market Expansion: Businesses can enter new markets more easily with the ability to accept local payment forms, thus driving growth and increasing revenue.

- Reduced Barriers: By accommodating diverse payment preferences, businesses minimize barriers to purchase, appealing to a broader audience.

Conclusion

In conclusion, MoneyCollect and local payment methods are indispensable tools for businesses aiming to thrive in the global marketplace. As alternative payment methods, they provide the flexibility, security, and local relevance needed to attract and retain a diverse customer base. By adopting these innovative payment solutions, businesses can ensure they stay competitive and responsive to consumer needs in an ever-evolving market.

Adapting to alternative payment methods like MoneyCollect can significantly impact your business, offering not just a way to keep up with market trends, but also to set the pace in the industry. As we continue to witness advancements in payment technologies, MoneyCollect and local payment methods will undoubtedly play critical roles in shaping the future of commerce.