In today’s fast-paced, economically interconnected world, dealmaking has become crucial to corporate growth and expansion strategies. As global markets evolve, mergers and acquisitions are potent tools for companies seeking growth and diversification.

However, the landscape is fraught with complexities driven by economic uncertainties and political dynamics. Recently, Peter Orszag highlighted the pressing challenges posed by tariffs, financial imbalances, and geopolitical tensions that redefine the dealmaking domain.

Key Takeaways:

- Understand the evolving landscape of dealmaking in a globally interconnected economy.

- Discover how external factors like tariffs and political shifts can impact strategic decisions.

- Learn strategies for successful deal making during uncertain times.

This article explores how organizations can effectively navigate global challenges, focusing on strategic agility and foresight. It emphasizes how crucial it is to comprehend contract negotiations’ complex circumstances to help firms close profitable and long-lasting agreements that support their overarching goals.

The Current State of Global Dealmaking

The current landscape of global deal making is vibrant yet challenging, characterized by an increasingly interconnected marketplace. Businesses seeking new growth avenues often turn to cross-border mergers and acquisitions to expand their market reach and diversify product portfolios. While opening doors to new opportunities, this global movement also introduces many challenges. Complex regulatory environments, cultural heterogeneity, and fluctuating economic conditions are just a few hurdles accompanying global transactions.

The rise of digital technology catalyzes global dealmaking, enabling seamless cross-border collaborations and negotiations. Digital platforms streamline the negotiation and transaction process, offering real-time communication and data analysis to support decision-making. In essence, technology is both an enabler and a foundation for conducting efficient global deals, helping companies navigate the intricate labyrinth of international business transactions.

Key Challenges Facing Dealmaking Today

The journey through the world of strategic mergers and acquisitions is fraught with numerous challenges that necessitate strategic navigation. Understanding what to expect regarding dealmaking is crucial in anticipating and overcoming these hurdles. Among the paramount challenges are complex legal regulations that vary by region and country, creating intricate legal landscapes that require nuanced understanding and strategic approach.

Cultural differences in business can complicate deal processes, necessitating companies to develop cross-cultural negotiation skills. By integrating cultural awareness into strategic frameworks, organizations can bridge these gaps, enhance trust, and strengthen cross-border partnerships, thereby overcoming challenges.

The Role of Political and Economic Factors

Political and economic influences are pivotal in shaping dealmaking strategies and outcomes. Regulatory shifts, trade policy changes, and financial climate fluctuations can significantly affect deal viability. For instance, the imposition of tariffs or sudden changes in trade agreements can disrupt anticipated deals and necessitate strategic realignments. Organizations must remain vigilant and responsive to such potential risks and opportunities.

Companies must stay informed about geopolitical shifts and macroeconomic trends to thrive in uncertain environments. They need foresight to anticipate changes and mitigate risks. Companies with robust strategic foresight can proactively adapt, maintain competitive advantages, and achieve sustainable growth in the fluctuating global arena.

Strategies for Successful Dealmaking

Developing resilient and adaptable strategies is essential for successful dealmaking outcomes in today’s competitive environment. Emphasizing flexibility and preparedness can empower organizations to navigate emerging challenges effectively. Agile methodologies are increasingly adopted to facilitate quick adjustments to changing market dynamics, ensuring companies remain responsive and competitive.

Additionally, fostering strong partnerships with local stakeholders provides invaluable insights and guidance in navigating complex foreign landscapes. Learning from real-world examples, organizations can distill key lessons and best practices, building frameworks that balance thoughtful caution with strategic opportunism. By incorporating these strategies, businesses can secure successful outcomes and create sustainable value in cross-border transactions.

Importance of Due Diligence

Due diligence forms a foundational pillar in pursuing successful mergers and acquisitions. Conducting comprehensive due diligence is instrumental in uncovering potential risks and evaluating the target company’s financial health, legal standing, and operational integrity. This involves scrutinizing financial statements, assessing legal liabilities, and examining operational efficiency.

Informed insights garnered through due diligence empower businesses to craft carefully considered integration plans that align with organizational strategies and objectives. By identifying synergies and areas of risk early, companies can maximize value creation while safeguarding against unforeseen challenges post-acquisition. Through diligent risk assessment and strategic preparation, organizations can enhance the success rate of their dealmaking endeavors.

Leveraging Technology in Dealmaking

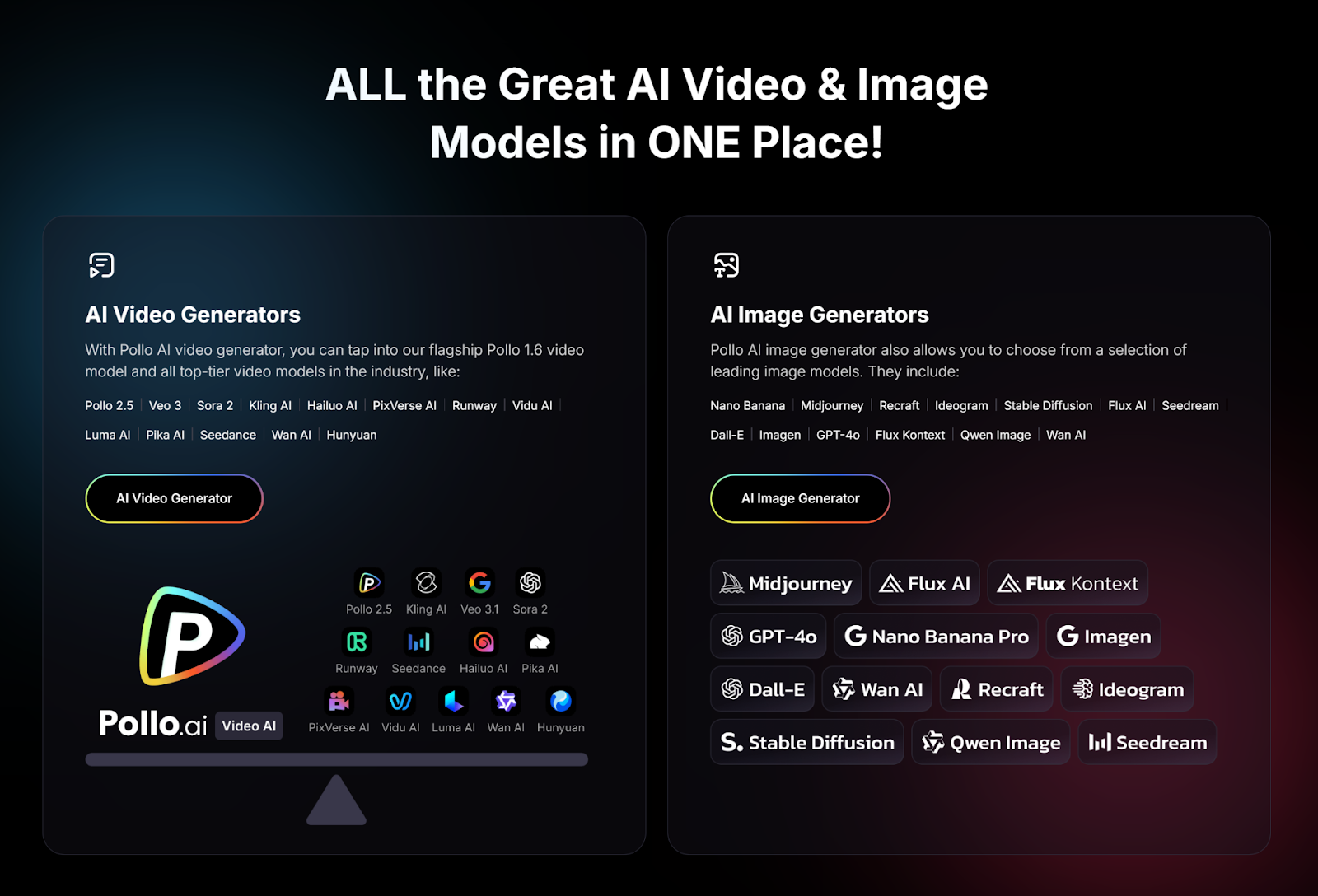

The infusion of technology into the dealmaking process has fundamentally transformed how companies pursue mergers and acquisitions. Advanced data analytics and artificial intelligence are powerful tools that drive more intelligent, data-driven decision-making. By utilizing AI and data analytics, businesses can obtain important insights into market trends, accurately evaluate possible acquisition targets, and expedite due diligence procedures with increased efficiency and precision.

Digital communication tools improve negotiation efficiency by enabling seamless stakeholder collaboration across geographical boundaries. They enhance operational efficiencies, minimize errors, and unlock growth opportunities. Companies can leverage these advancements to improve strategic capabilities and drive successful deal outcomes in a complex market.

Conclusion

Global deal making requires a deep understanding of political, economic, and technological landscapes. Businesses can use strategic insights, creative ideas, and foresight to open up new avenues and generate value through profitable transactions. Companies must remain adaptable, update strategic frameworks, and stay informed about global trends. Integrating technological tools and risk management strategies into organizational processes allows businesses to capitalize on opportunities, secure competitive advantages, and drive growth in a volatile world.