Trading signals play a crucial role in guiding binary options traders’ decisions, providing valuable insights into potential market movements and trading opportunities. On Quotex, traders can utilize various types of signals to inform their trading strategies and improve their chances of success. In this guide, we’ll explore how to interpret and effectively utilize trading signals on the Quotex platform for successful trading.

Understanding Trading Signals

Types of Signals: Quotex offers a variety of trading signals, including technical signals based on price action and indicators, fundamental signals derived from economic news and events, and social signals from market sentiment analysis and crowd behaviour.

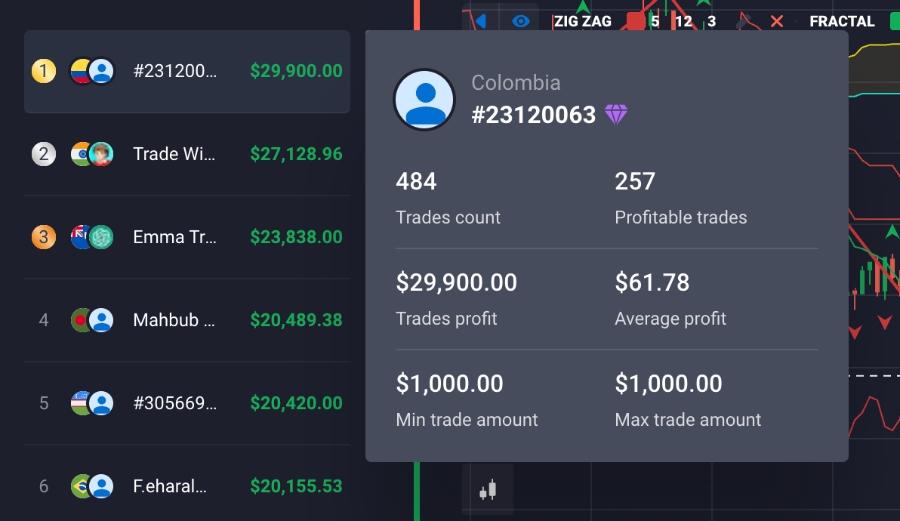

Signal Providers: Traders can access signals from various sources, including built-in signal providers on the Quotex platform, third-party signal services, and proprietary signal algorithms. Evaluate the credibility and reliability of signal providers before incorporating their signals into your trading strategy.

Interpreting Trading Signals

Entry Signals: Look for clear entry signals provided by trading indicators, chart patterns, or fundamental news events. Entry signals indicate opportune moments to open binary options positions based on predetermined criteria.

Confirmation Signals: Seek confirmation of trading signals from multiple sources or indicators to increase their reliability. Confirmation signals validate the initial signal and provide additional confidence in the trading decision.

Utilizing Trading Signals

Incorporate into Strategy: Integrate trading signals into your existing trading strategy to complement your analysis and decision-making process. Use signals to identify potential entry and exit points, confirm trade setups, and adjust risk management parameters.

Back-testing: Backtest trading signals using historical data to assess their effectiveness and performance under various market conditions. Validate the signals’ reliability and refine your strategy based on back-testing results.

Risk Management with Signals

Risk Assessment: Evaluate the risk associated with each trading signal based on factors such as market volatility, signal strength, and risk-reward ratio. Adjust position sizes and risk management parameters accordingly to protect capital.

Stop Loss and Take Profit: Set stop-loss and take-profit levels based on trading signals to manage risk and secure profits. Ensure that stop-loss levels are placed at logical support or resistance levels to limit potential losses.

Continuous Monitoring and Adaptation

Market Monitoring: Continuously monitor market conditions and adjust your trading strategy based on evolving signals and market dynamics. Stay informed about economic news releases, technical developments, and sentiment shifts that may impact trading signals.

Adaptation: Adapt your trading approach based on the performance of trading signals over time. Modify signal parameters, refine entry and exit criteria, or switch signal providers if necessary to optimize performance and adapt to changing market conditions.

Conclusion

Trading signals are valuable tools for binary options traders on the Quotex platform, providing insights into potential market movements and trading opportunities. By understanding how to interpret, utilize, and manage trading signals effectively, traders can enhance their decision-making process, improve their trading strategies, and increase their chances of success in binary options trading on Quotex. Remember to integrate trading signals into a comprehensive trading plan, practice disciplined risk management, and continuously monitor and adapt to market changes for optimal results.