A smooth transaction often starts before you open the operation page. The feeling of peace comes from organizing clean data, understanding the processing flow and practicing a few small security habits. This article acts as a guide for you to confidently touch 123B deposit for the first time as if walking on a familiar path, while also preparing “soft landing” plans in case of problems. When you understand why each step is needed, you will find everything less mysterious and easier to control. From today, consider depositing money 123B is a disciplined process, not a gamble of chance.

Platform ready for a perfect order

Before you hit confirm, the best platform is one you’ve spent a few minutes vetting. When the information matches, the method is authenticated, and security is enabled in the right order, the order has every reason to go straight through rather than veering off into manual review. It’s all about the mental preparation that goes into getting the journey to a “naturally smooth” state the first time.

KYC match and clean data

The identification file is the first key to open the processing gate. Make sure your full name, date of birth, and valid ID number match your account information exactly. If you have abbreviated, omitted accents, or changed your name to a new ID, you should update it before proceeding to avoid the pending verification status. A clear, well-lit, and uncropped photo helps the system recognize faster and builds trust in the data right from the start.

Link the receiving account with the same owner name

The method of receiving money should be in your name and match the identified profile. Borrowing a relative’s account can easily cause the order to be suspended due to the fraud prevention mechanism. When adding a bank account or wallet, you enter each character slowly, check the display name returned by the system, and keep the authentication receipt if there is an identified transfer step. Those small details are a convincing layer of evidence, especially useful when needing to check later in the 123B deposit journey.

Two-factor authentication and OTP management discipline

Two-factor authentication is not a cumbersome procedure, but a shield against impersonation. You should prioritize code-generating applications so that you do not depend on mobile signals. When entering OTP, get into the habit of looking carefully for a moment before typing, avoiding mistakes due to haste. When you suspect a strange call or message asking for a code, you immediately close that channel and only operate through the main portal. This small discipline is the invisible safety rope for the entire process.

Operate at the right rhythm for fast browsing

When the platform is in place, the action becomes as easy as letting go of the accelerator on a straight line. However, there are “rhythm” rules that help the system evaluate low-risk orders and thus prioritize going through the green line. You will find things much smoother when you know when to pause half a beat and let the data speak for itself.

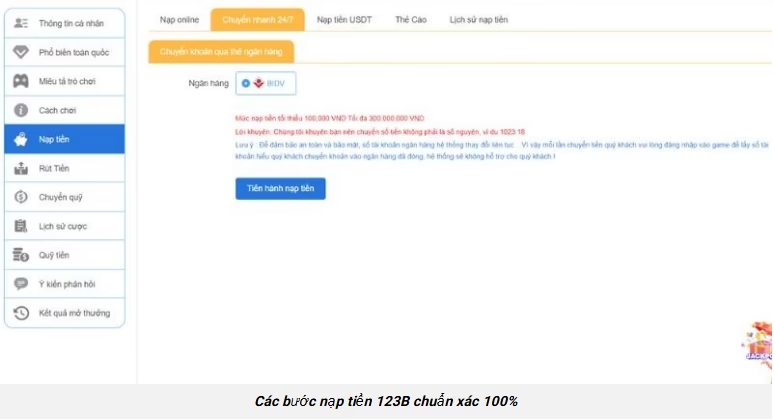

Select a valid source and amount

A system can split the balance between wallets, so make sure you transfer it to your main wallet before entering the amount. Read the minimum and maximum carefully, and note the number of orders allowed per day. For large amounts, splitting by limits not only reduces the risk of mistakes, but also helps keep the processing queue smooth. In the input field, avoid strange characters and let the system calculate the fee, so the actual amount received is transparent and consistent.

Realistic time frames and expectations

Processing times are not always the same. Bank business hours, weekdays, and avoiding maintenance windows are all important points to consider. Before clicking confirm, quickly read the estimated time to set appropriate expectations. The sense of calm after clicking the button comes mainly from knowing what you are waiting for, how long, and why it might take a little longer.

Take notes, keep track, and track status

The notes field, if present, is an opportunity for you to attach a personal reference code for easier tracking later. When an order is formed, you take a screenshot of the transaction code and track the status in one place to avoid creating multiple overlapping requests. If there is a progress screen, the habit of looking back after a few minutes instead of constantly refreshing will reduce psychological pressure and keep the mental rhythm clear.

Troubleshooting and long-term optimization

The problem doesn’t define the experience, how you handle it does. A hang-up usually has a very specific cause. Getting things back to normal, preparing the right data, and knowing when to reach out will turn the curve into a straight line. From there, each subsequent time will be faster, cleaner, and more secure throughout the 123B deposit journey.

Decoding common errors

The most common error is that the recipient account name does not match the profile. The correct solution is to adjust to match, or update the profile if the legal information has just changed. In case of exceeding the day limit, you wait for the next milestone instead of trying to send more orders, because the system will only add a queue without being able to process. With OTP errors, do not try continuously in frustration; you re-sync the system time on the phone, wait for a new round of codes and then enter slowly, avoiding wasting more time on temporary unlocking.

When the estimated time with a reasonable buffer is exceeded, you summarize the situation neatly and send it to the support team with the transaction code, time of order creation, deposit method, and screenshot. A clear question will get an answer faster than any complaint. When the voucher code is given, you write it down for tracking. Data dialogue not only helps the problem to be handled early, but also creates a useful record for the next time.

Safety practices and local legal frameworks

A good transaction must stay within the framework. It is your responsibility to verify the legality of your place of residence and comply with age restrictions if applicable. Beyond the legal, personal habits such as setting time limits, regular reminders to take a break, locking the screen when leaving the device, and regularly updating the app will keep the whole experience streamlined, consistent, and surprise-free. It is these small habits, repeated in the right rhythm, that make the next 123B top-up even easier than the first.

Conclude

A smooth trade is rarely a fluke. It’s the result of some straightforward preparation, disciplined execution, and working with data rather than emotion. You go from matching IDs to standard acceptance methods, from two-factor authentication to valid funds, from reading timeframes to smart tracking, and then calmly observing the status. If necessary, you contact support with a neat summary. Once it’s all in place, every time Nạp tiền 123B Next is just a touch away, with a sense of security that was built from the start.