In the realm of property insurance claims, efficiency and effectiveness are paramount. Whether facing damage from natural disasters or unexpected accidents, navigating the complexities of insurance claims can be daunting. However, with the assistance of a public adjuster Florida, individuals can streamline the process and ensure a smoother resolution.

Understanding the Role of a Public Adjuster

At the forefront of the insurance claim process lies the public adjuster, a crucial figure in Florida’s insurance landscape. These professionals serve as stalwart advocates for policyholders, championing their rights and interests throughout every stage of the claims process. Armed with specialized knowledge and expertise, public adjusters meticulously assess property damage, meticulously evaluate insurance policies, and skillfully negotiate settlements with insurance companies on behalf of policyholders.

With their extensive qualifications and certifications, public adjusters provide policyholders with a level of comprehensive support and representation that is unparalleled in the insurance industry. From initial assessment to final resolution, policyholders can trust in the guidance and expertise of public adjusters to navigate the complexities of insurance claims with confidence and assurance.

Assessing Property Damage and Documentation

At the heart of streamlining the insurance claim process lies the meticulous assessment of property damage and the accompanying documentation. Public adjusters operating in Florida are adept at utilizing cutting-edge techniques and technology to conduct thorough evaluations of the damage incurred. Employing advanced tools and methodologies, they ensure precise assessments that leave no aspect overlooked.

Furthermore, public adjusters excel in compiling comprehensive documentation, encompassing detailed photographs, videos, and written descriptions of the damage. This meticulous approach not only strengthens the validity of the claim but also provides compelling evidence to support the policyholder’s case. By harnessing these resources effectively, policyholders can expedite the resolution process and increase their chances of securing fair and timely compensation for their losses.

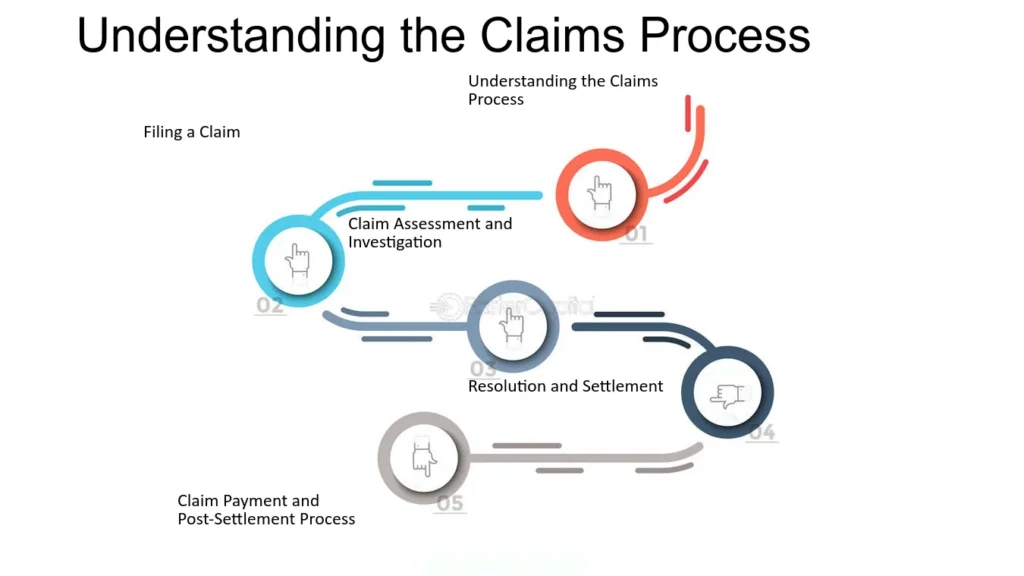

Initiating the Claim Process

Prompt action is paramount when commencing the insurance claim process, emphasizing the importance of timeliness. Upon encountering property damage, swift notification to the insurance company is crucial to initiate the process promptly. Public adjusters in Florida play a pivotal role in guiding policyholders through these initial steps, ensuring that all requisite documentation is compiled accurately and expediently.

By facilitating efficient communication and documentation submission, public adjusters enable policyholders to establish a solid foundation for the subsequent stages of the claims process. Proactive engagement with the insurance company not only expedites the resolution process but also enhances the likelihood of a streamlined and favorable outcome for the policyholder.

Advocacy and Negotiation

One of the primary benefits of engaging a public adjuster in Florida is their proficiency in advocacy and negotiation. These professionals act as unwavering champions for policyholders, steadfastly defending their rights and interests from start to finish during the claims process. With an extensive understanding of insurance policies and regulations, public adjusters adeptly navigate negotiations with insurance companies.

Leveraging their expertise, they tirelessly strive to secure fair and just compensation on behalf of policyholders. By entrusting their claim to a seasoned public adjuster, policyholders can approach negotiations with a sense of assurance, knowing that their interests are being represented vigorously and effectively. This partnership empowers policyholders to navigate the intricate landscape of negotiation with confidence and clarity.

Expedited Resolution Strategies

To hasten the resolution of insurance claims, public adjusters in Florida employ a myriad of strategic approaches. Alternative dispute resolution methods, such as mediation or arbitration, are favored alternatives to protracted litigation processes. By opting for these methods, public adjusters can expedite the resolution of disputes while minimizing the time and resources expended. Moreover, collaboration with other professionals, including contractors or legal experts, further bolsters the efficiency of the resolution process. By leveraging their expertise in specific areas, these professionals contribute valuable insights and perspectives, thereby facilitating swift resolution and reducing the likelihood of delays.

By implementing these expedited resolution strategies, public adjusters play a pivotal role in accelerating the claims process for policyholders. Through their proactive efforts and collaborative approach, they enable policyholders to swiftly recover and rebuild in the aftermath of property damage. By minimizing delays and streamlining the resolution process, public adjusters empower policyholders to navigate the claims process with confidence and efficiency, ultimately facilitating a smoother path to recovery.

Conclusion

Navigating the intricacies of property insurance claims can be a challenging endeavor. However, by leveraging the expertise of a public adjuster in Florida, policyholders can streamline the process and achieve a favorable outcome. From assessing property damage to advocating for fair compensation, public adjusters play a pivotal role in expediting the resolution of insurance claims. As policyholders confront unforeseen challenges, seeking assistance from a public adjuster ensures a smoother and more efficient claims process.