In a world where almost everything happens online, businesses face a growing challenge: how do you know that the person on the other side of the screen is who they say they are? Fraud, identity theft, and unauthorized access are no longer occasional risks; they’re everyday threats. This is why identity verification services have become indispensable. They help businesses confirm identities quickly and accurately, protect sensitive data, and ensure that customers can trust every interaction.

Without robust verification, both companies and their users are exposed to potentially costly and damaging risks.

Let’s explore how these services are transforming digital security, enhancing customer trust, and why adopting them is no longer optional but essential for businesses in the digital age.

Why Digital Transformation Brings New Risks

The move to digital platforms has transformed the way businesses operate. Online services allow companies to reach customers globally, reduce operational costs, and offer faster, more convenient experiences. But here’s the thing: with convenience comes risk.

Cybercriminals are becoming increasingly sophisticated, exploiting weak verification processes to steal identities, commit fraud, or bypass security protocols. A single fraudulent transaction can result in financial loss, regulatory fines, and damage to a company’s reputation.

Traditional verification methods, like checking physical documents or manual approval processes, are no longer enough. They are slow, prone to human error, and cannot keep up with the scale or complexity of digital business operations. This gap has made identity verification services not just useful, but essential for modern businesses.

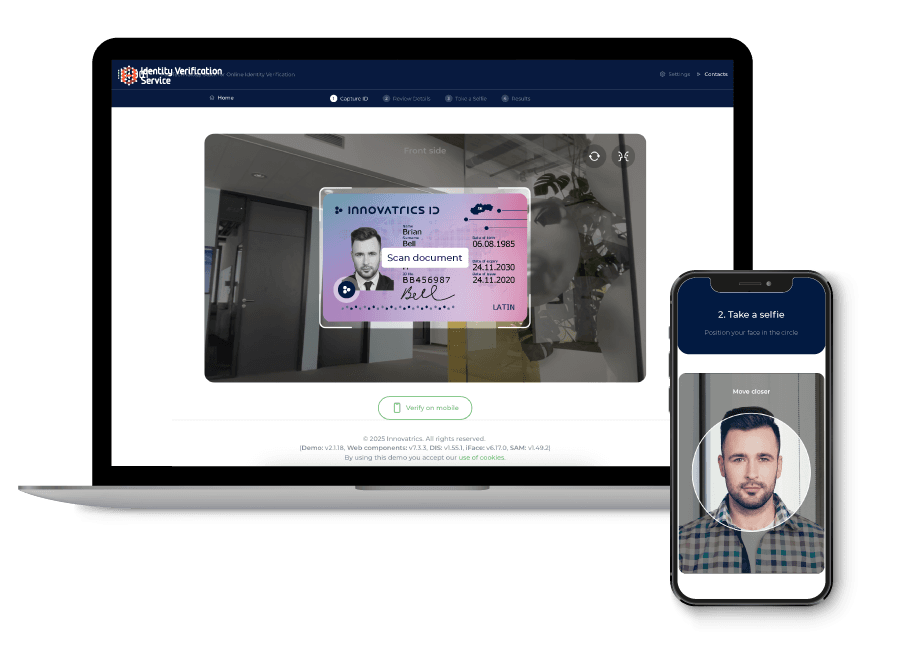

How Identity Verification Services Work

Identity verification services use a combination of advanced technologies to ensure that a person or business is truly who they claim to be. These tools go far beyond traditional checks, providing businesses with the ability to verify identities quickly, accurately, and at scale. Here’s how they work:

- Biometric Authentication:

This involves using unique physical characteristics—such as fingerprints, facial recognition, or voice patterns—to confirm identity. For example, a fintech app might require a facial scan to ensure that the person opening an account matches the ID they submitted. Biometrics make it extremely difficult for fraudsters to impersonate someone else.

- Artificial Intelligence and Machine Learning:

AI algorithms are trained to recognize patterns and detect anomalies in user behavior. These smart systems can flag suspicious activity, such as multiple accounts being created from the same device or unusual login locations, helping prevent fraud before it happens.

- Document Verification:

Identity verification services can automatically scan and validate government-issued IDs, passports, and business licenses. By checking the authenticity of these documents, businesses can ensure that submitted information is genuine, reducing the risk of fake accounts or identity theft.

- Global Data Integration:

Advanced services cross-check user information against multiple databases, credit bureaus, and public records worldwide. This ensures verification is thorough and accurate, even for international users, making it especially valuable for businesses operating across borders.

By leveraging these tools, businesses can quickly and accurately verify users in real time, reducing fraud risk while maintaining a smooth experience for legitimate customers.

Key Benefits of Implementing Identity Verification Services

The advantages of using identity verification services go far beyond security. They impact your bottom line, your operational efficiency, and your brand reputation.

- Fraud Prevention: Fraud is expensive. Identity theft, account takeovers, and fake accounts can lead to millions in losses. Verification services act as a frontline defense, preventing unauthorized access before damage occurs.

- Regulatory Compliance: Many industries face strict compliance requirements. Financial services, cryptocurrency platforms, and lending institutions must adhere to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. Identity verification services automate compliance checks, reducing the risk of costly penalties.

- Improved Customer Trust: Customers are more likely to engage with businesses that prioritize their security. Demonstrating a commitment to verifying identities builds trust, increases retention, and enhances overall user satisfaction.

- Operational Efficiency: Manual verification processes are time-consuming and resource-intensive. Automating identity checks speeds up onboarding, reduces human error, and frees up staff for higher-value tasks.

Real-World Applications Across Industries

Identity verification services are not limited to banks or fintech companies. Here’s how different sectors are benefiting:

- Financial Services: Banks and digital wallets use verification to secure accounts, prevent fraud, and comply with regulatory standards.

- E-Commerce: Online retailers verify users to prevent fraudulent purchases, fake accounts, and chargebacks.

- Healthcare: Providers protect sensitive medical data by verifying patient identities before granting access.

- Government Services: Agencies ensure that only authorized individuals access public services, reducing fraud and identity misuse.

- Cryptocurrency & Digital Assets: Platforms verify traders and investors, mitigating risks associated with fraud and money laundering.

Choosing the Right Identity Verification Service

Not all services are created equal. Choosing the right one requires careful consideration of several factors:

- Accuracy: Look for services that minimize false positives and negatives, ensuring legitimate users aren’t blocked.

- Compliance: The provider should adhere to relevant local and global regulations, including KYC and AML standards.

- Scalability: Ensure the solution can handle growing verification volumes as your business expands.

- User Experience: A verification process that is seamless and user-friendly keeps customers happy and reduces drop-offs.

- Integration: The service should integrate smoothly with your existing systems and workflows, minimizing disruption.

Investing in the right platform ensures that your business stays secure, compliant, and efficient.

Why Businesses Can’t Afford to Wait

The digital era is evolving fast, and so are the methods criminals use to exploit it. Waiting to implement identity verification services is a risk businesses can no longer afford. Fraud and non-compliance not only hurt finances but also erode customer trust—a critical factor in today’s competitive market.

Businesses that act now benefit from:

- Reduced risk of identity fraud and financial loss

- Simplified compliance with global regulations

- Faster onboarding for customers, improving satisfaction

- A stronger reputation as a secure, trustworthy brand

Wrapping Up

As digital interactions grow, so does the need for strong security. Identity verification services are essential for protecting businesses and customers from fraud, identity theft, and compliance issues. Using a reliable verification solution isn’t just about security; it builds trust, improves efficiency, and supports long-term growth.

AiPrise offers a platform with AI-powered automation, global coverage, and easy integration to keep your business secure and your customers confident.