The landscape of the housing market is continually shifting, and the role that mortgage brokers play in the industry has evolved alongside these changes. As we look towards 2025, numerous factors such as technology, regulation changes, and consumer expectations are set to redefine a broker’s place in the financial ecosystem once more.

Technological Integration and Brokering

By 2025, technology is expected to be even more integrated into the mortgage brokering process. This will likely involve sophisticated Artificial Intelligence (AI) systems that can quickly analyse large sets of data, making it easier for brokers to tailor solutions for each client’s unique financial situation. The rise of digital platforms is also set to streamline the application process, reducing the need for cumbersome paperwork and enabling faster preliminary approvals.

Increased Regulatory Compliance

In the face of growing scrutiny, regulatory compliance will remain a core aspect of the mortgage brokering industry. By 2025, we can anticipate even tighter controls and frameworks that brokers will have to navigate. The role of the broker will thus expand to include ensuring that all transactions adhere to the latest financial guidelines and consumer protection laws.

Focus on Consumer-Centred Service

Consumer expectations are always on the rise, and personable, bespoke service will be paramount by 2025. Mortgage brokers will need to sharpen their skills in customer engagement, offering more than just competitive rates by providing holistic financial advice and long-term planning strategies for clients.

Education and Advocacy

The mortgage broker of 2025 will also serve as an educator and an advocate for clients. As financial products and the housing market become increasingly complex, brokers will be expected to guide clients through the intricacies of mortgages, ensuring they understand all terms and conditions.

Expanding Scope of Services

While traditionally focused on home loans, mortgage brokers may broaden their scope of services to include product comparisons in other areas such as insurance and personal finance, therefore positioning themselves as a one-stop-shop for financial advice and solutions. This would further cement their role as trusted advisors in the financial landscape.

Specialisation and Niche Markets

As the market diversifies, there will be more opportunities for mortgage brokers to specialise. By 2025, niches such as eco-friendly property loans, microfinance, and commercial investments might become more prevalent, offering brokers a chance to carve out a specific market segment and audience.

Building Long-Term Client Relationships

The success of mortgage brokers will continue to rely on the quality of the relationships they forge with clients. By 2025, brokers who focus on building and maintaining these connections are likely to enjoy repeat business and referrals. The emphasis will be on becoming a trusted financial partner rather than a once-off service provider.

Collaboration with Industry Professionals

Increased collaboration with real estate professionals, financial planners, and solicitors may become more common place by 2025. This could create integrated service networks that benefit clients through a seamless home-buying experience.

Competitive Differentiation

In an industry where competition is fierce, brokers will need to articulate their value proposition clearly. This includes demonstrating their expertise, local market knowledge, and their ability to secure favourable terms for their clients whilst providing an efficient and personalised service.

Adaptation to Market Changes

The mortgage brokers who succeed in 2025 will be those who are agile enough to adapt to market fluctuations. Whether it involves responding to interest rate changes, economic shifts, or property trends, flexibility and the ability to give informed, current advice will be indispensable.

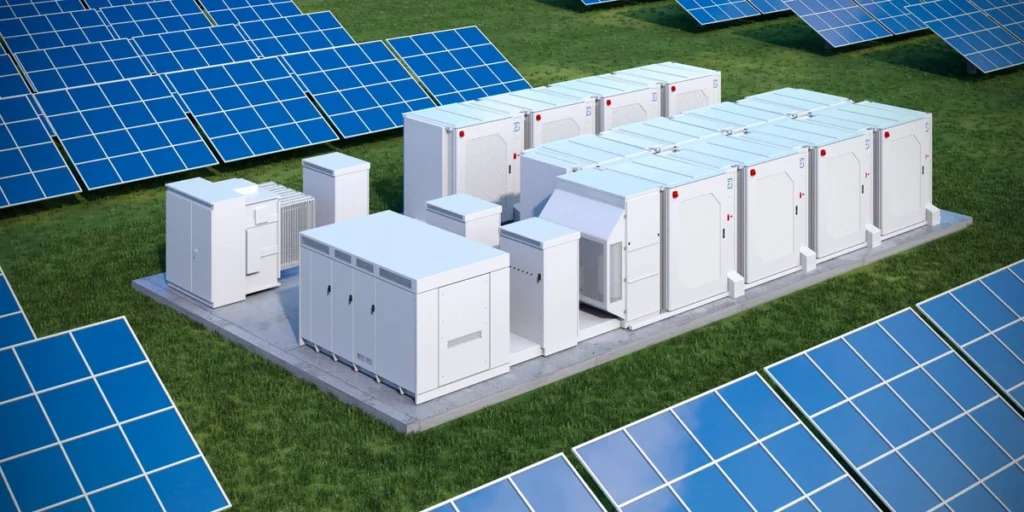

Embracing Sustainable Practices

A growing trend that is likely to influence the role of mortgage brokers by 2025 is the consumer shift towards sustainability. Brokers will be expected to offer products that support eco-friendly housing and sustainable living choices, thus aligning with the environmental values of their clients.

Ethical Standards and Transparency

Ethical lending practices and transparency in operations will also define the role of a mortgage broker in 2025. Consumers will expect clear information about commissions, fees, and the benefits and drawbacks of each product offered.

Conclusion

As 2025 approaches, the role of mortgage brokers is set to become more multifaceted than ever. By adopting new technologies, adhering to stringent regulations, and enhancing their customer service, they will continue to be an integral part of the homebuying process. It’s a future that promises both challenges and opportunities for those willing to embrace the evolving nature of the industry.